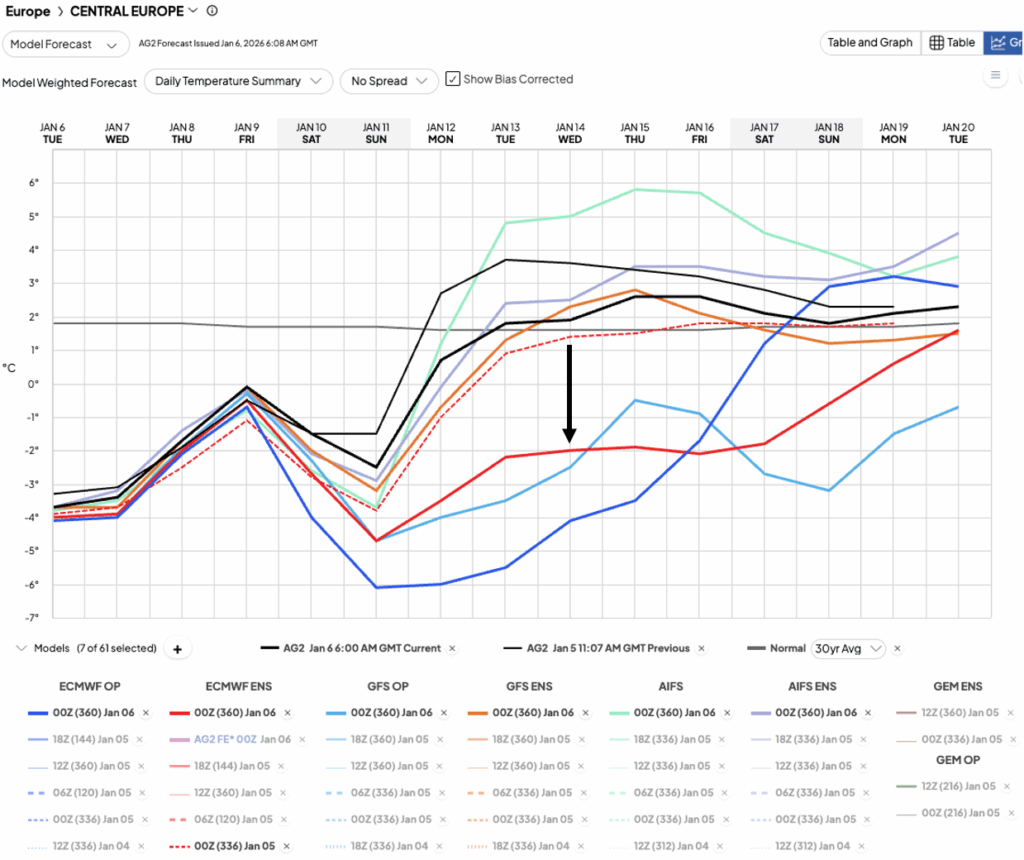

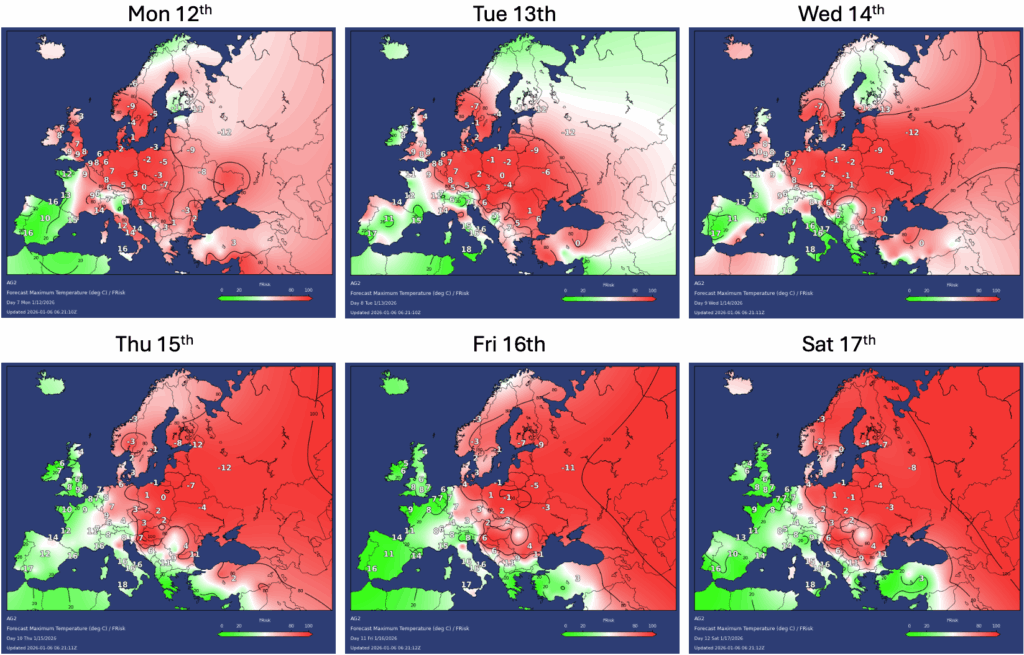

Bottom line: There have been significant colder moves in the latest 00z ECMWF ENS next week due to uncertainties in the extent of milder air from the Atlantic moving in across Europe. Confidence has therefore dropped in the forecast next week in the battleground between milder air trying to move in from the Atlantic, and the colder pool of air across eastern Europe. Alongside the colder moves in the latest 00z ECMWF ENS, German winds have also dropped lower. FRisk graphics show the highest risks next week are across central and eastern Europe, so we should expect forecast changes here. While to the far west, there is lower forecast risk, or higher confidence here. The latest AG2 forecast currently lies closer to the 00z GFS ENS which begins to recover temperatures closer to the seasonal normal next week. Overall, a low confidence forecast now next week, with a moderate risk from the 00z ECMWF ENS that temperatures could remain lower for longer.

AtmosphericG2 Blog

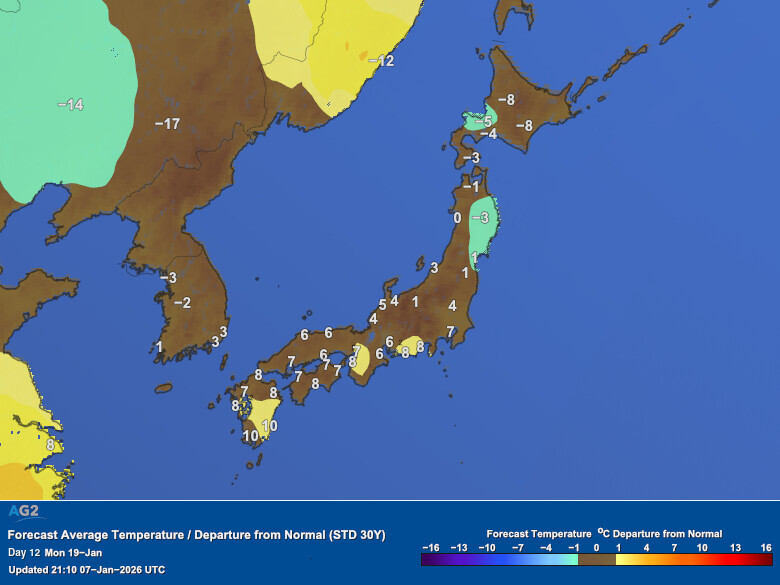

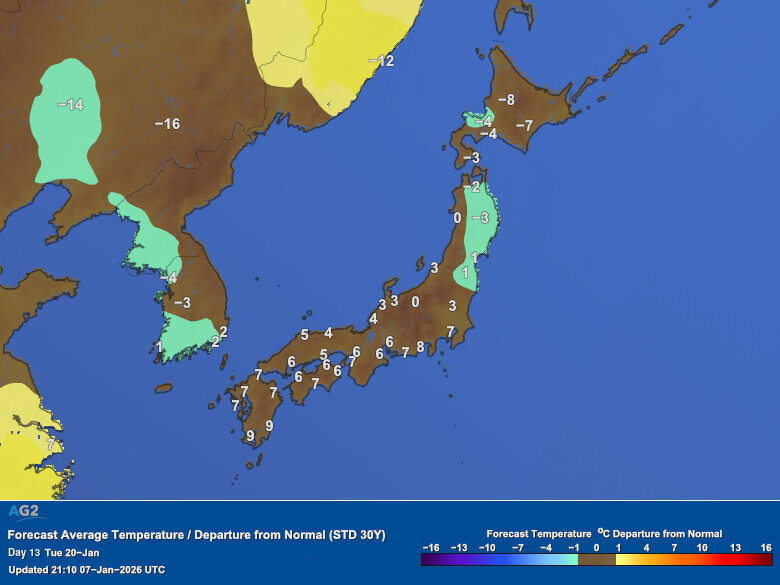

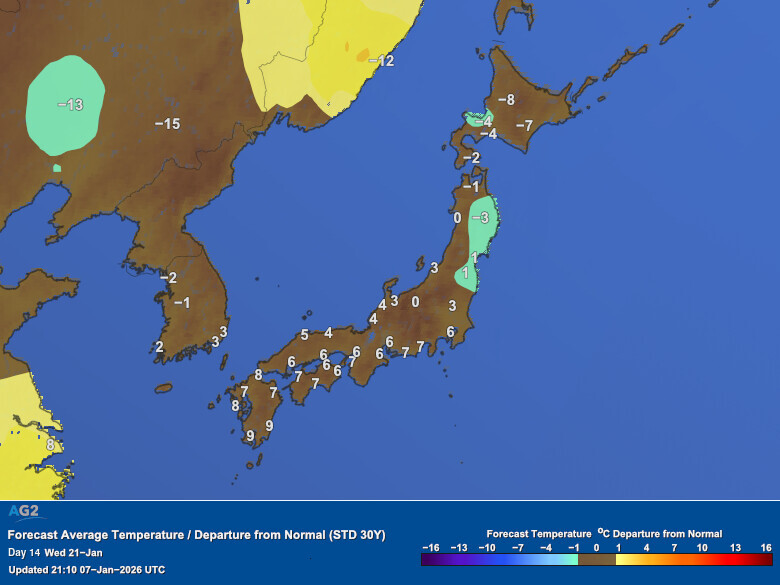

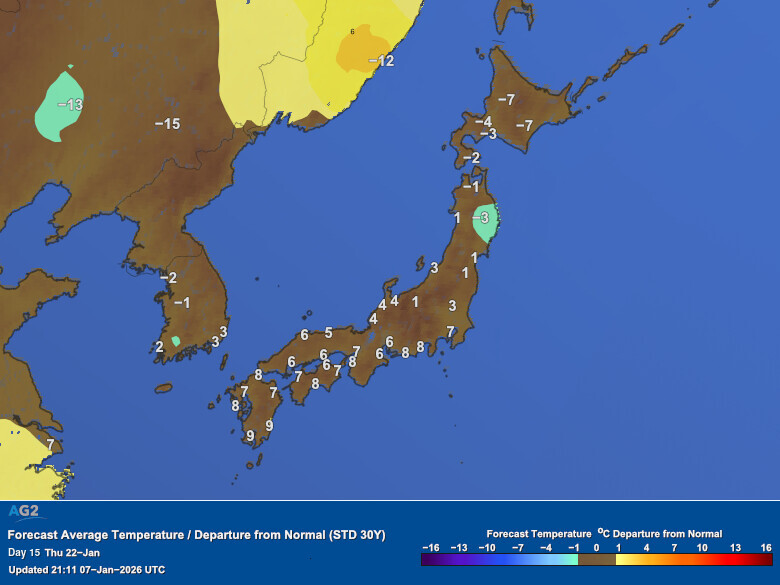

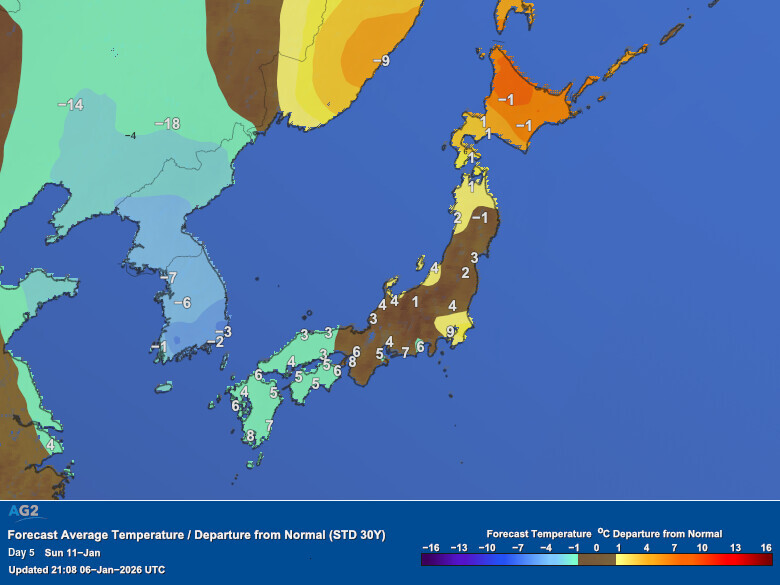

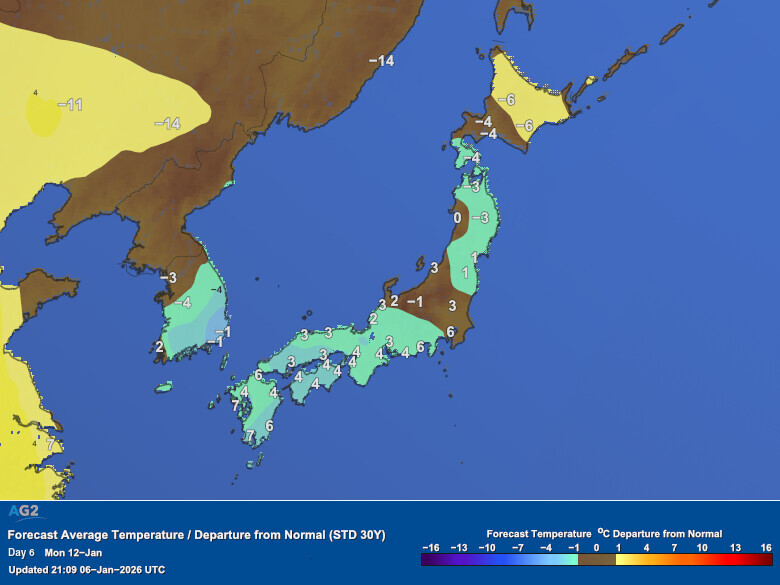

From Monday the 19th onward, temperatures across Japan are currently forecast to be near normal, except for parts of northeastern Japan.

However, the key question is whether this outlook is stable—or if there is potential for change.

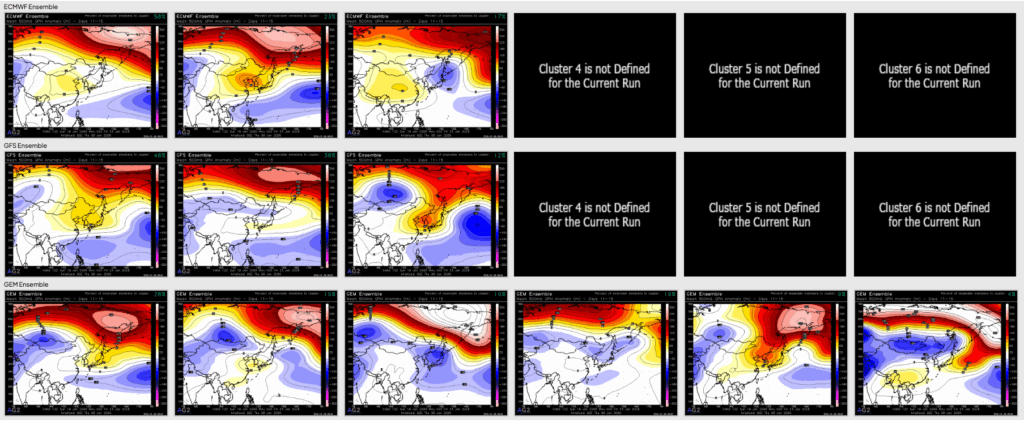

Looking at the latest 500mb geopotential height anomaly ensemble clusters from ECMWF, GFS, and GEM, there is a mix of scenarios. Some clusters show negative anomalies over Japan, while others show positive anomalies, indicating ongoing uncertainty in the upper-level pattern.

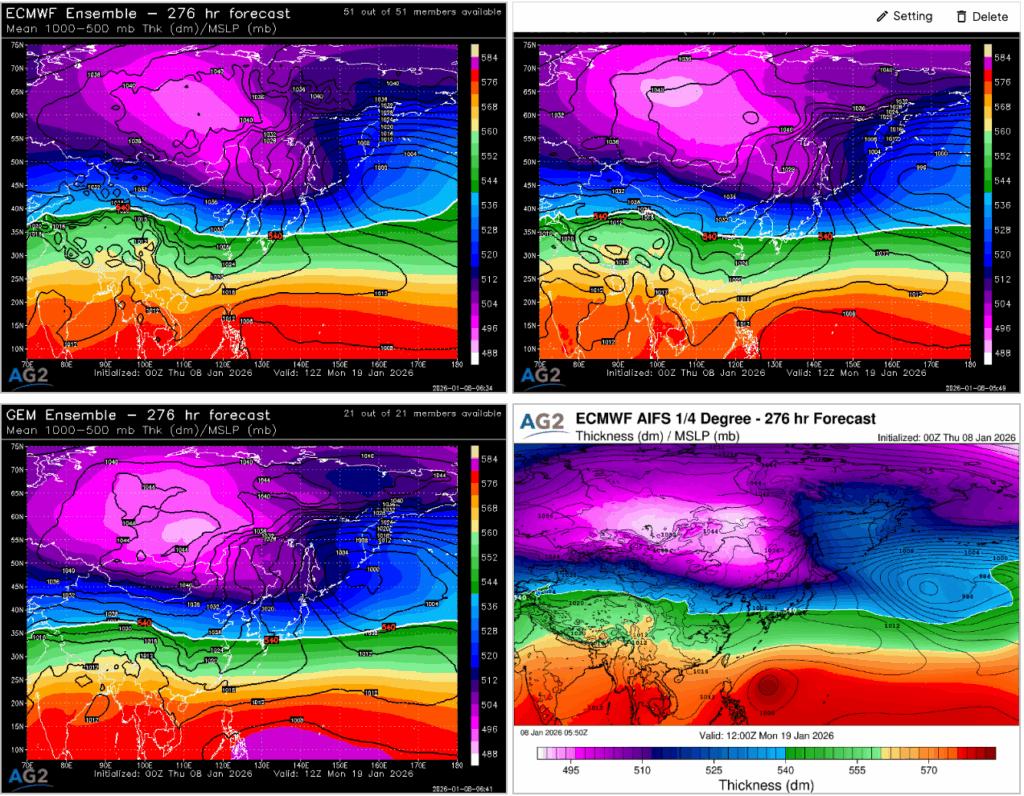

In addition, mean sea-level pressure ensemble forecasts show some members with north–south aligned isobars near Japan, which suggests a possible shift toward a winter-type pressure pattern. This pattern could persist through around the 23rd.

Although confidence is still limited given the 10+ day lead time, it is important to monitor the risk of:

- A persistent winter-type pattern after the 19th,

- Below-normal temperatures across much of Japan, and

- An increased risk of heavy snowfall along the Sea of Japan coast.

This period warrants close attention as forecast confidence improves.

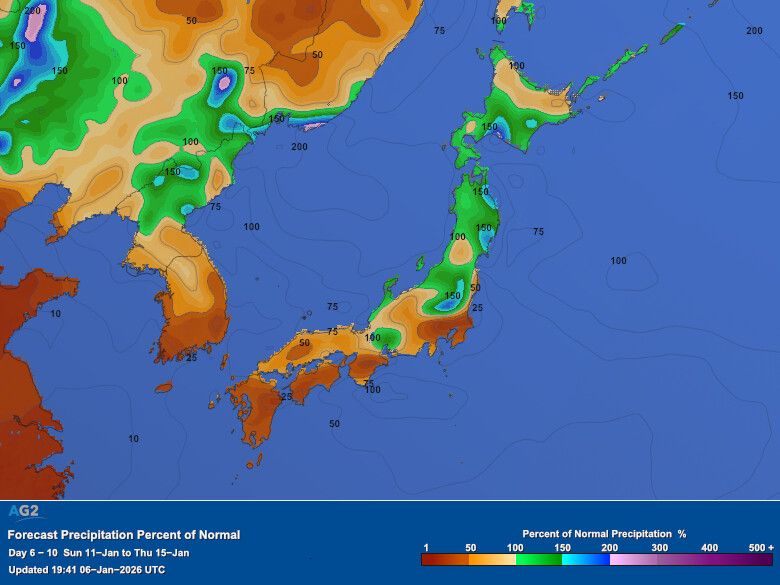

Over the next two weeks, Japan is expected to see repeated short cold spells. A strong cold air outbreak will affect the country during the long weekend, bringing more wintry conditions. However, the impact will vary by region.

In western Japan, colder-than-normal temperatures are expected on Sunday and Monday due to strong Siberian cold air.

Meanwhile, northern Japan and the Sea of Japan side of eastern Japan face an increased risk of heavy snowfall, both in lowlands and mountainous areas.

Precipitation has already been above normal along the Sea of Japan coast, and snowfall may increase further on Sunday and Monday.

What is driving these repeated cold intrusions? The pattern appears to be influenced by both tropical and Arctic factors.

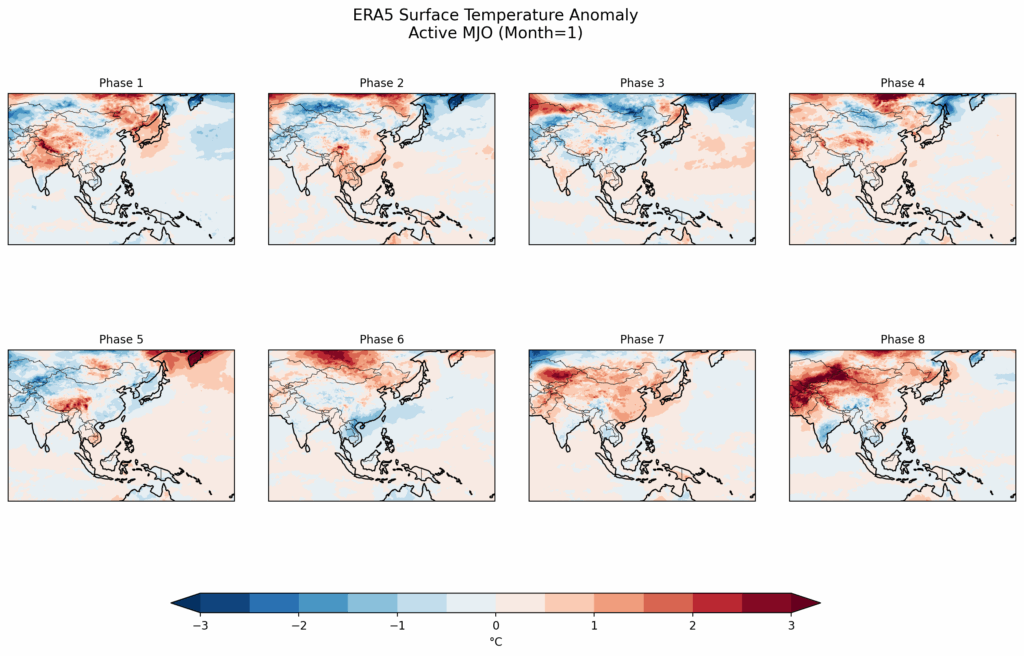

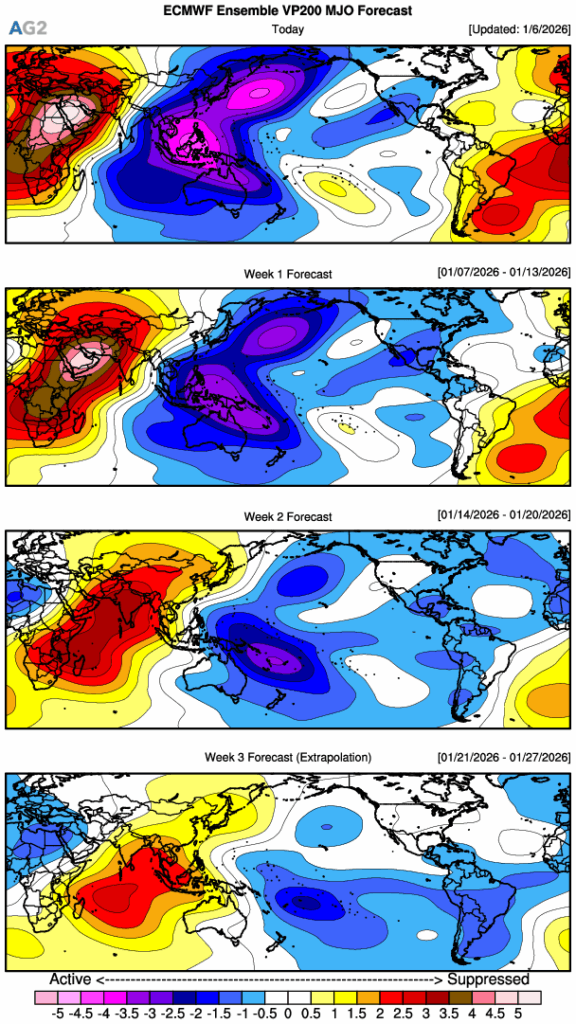

From the tropical side, the Madden–Julian Oscillation (MJO) is currently in Phase 5 near the Maritime Continent.

Historically, this phase is associated with cooler-than-normal conditions in Japan.

In addition, the MJO is forecast to strengthen in Phase 6 over the western Pacific during the next two weeks, a phase that often brings colder conditions to western Japan.

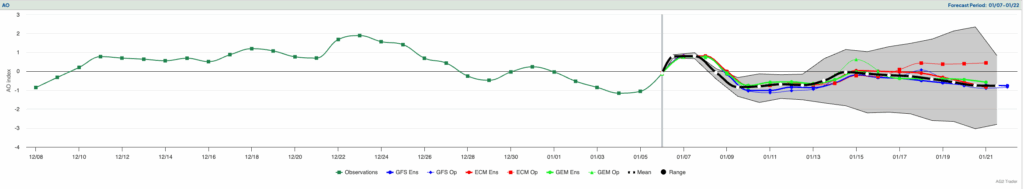

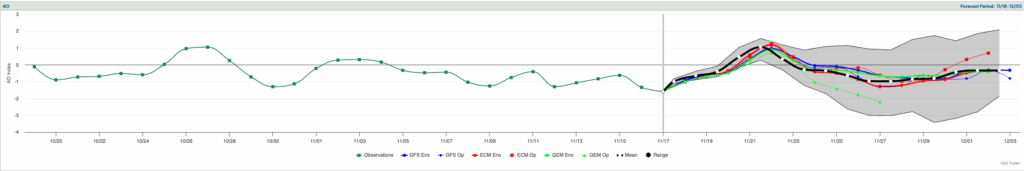

From the Arctic side, the Arctic Oscillation (AO) is forecast to turn negative after January 8. Ensemble guidance also leans negative, suggesting Arctic cold air can more easily move south into mid-latitudes.

However, the key question is how much of that cold reaches Japan. Looking at 500mb height anomalies through Day 15, most model scenarios show positive anomalies over Japan, indicating relatively stable conditions. Only a small number of clusters, mainly from the GEM model, show strong cold anomalies over East Asia.

As a result, the main scenario is that Japan experiences frequent but short-lived cold spells, while overall temperatures remain near normal or slightly above normal through the 15-day period.

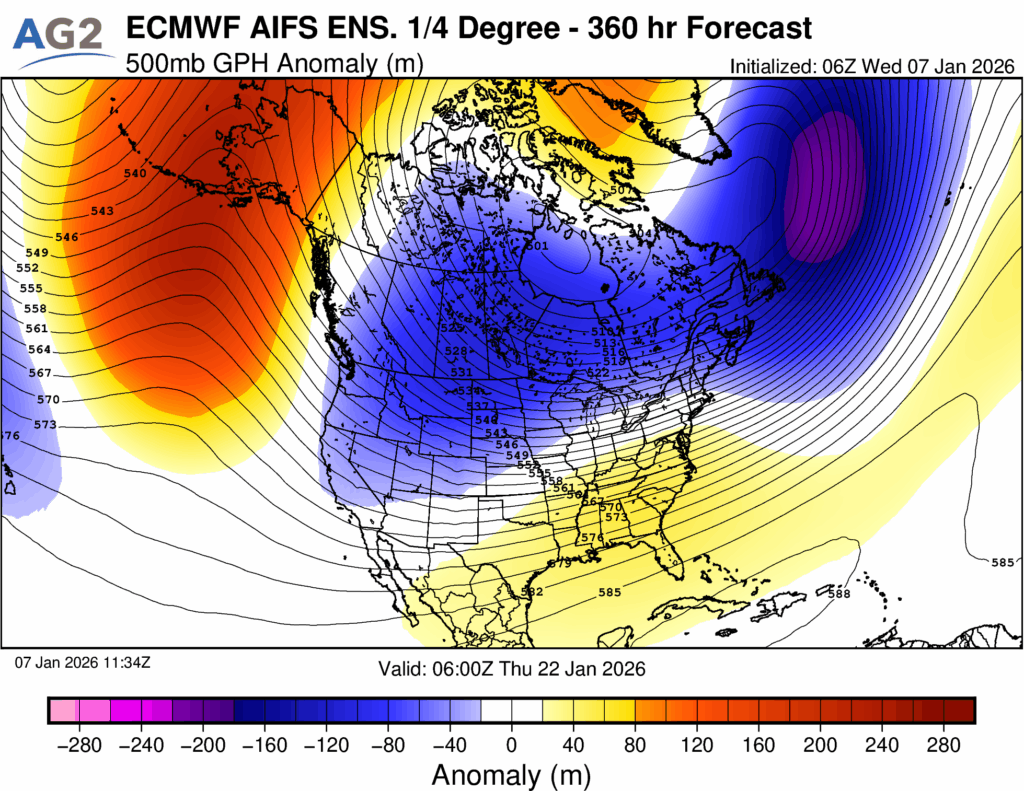

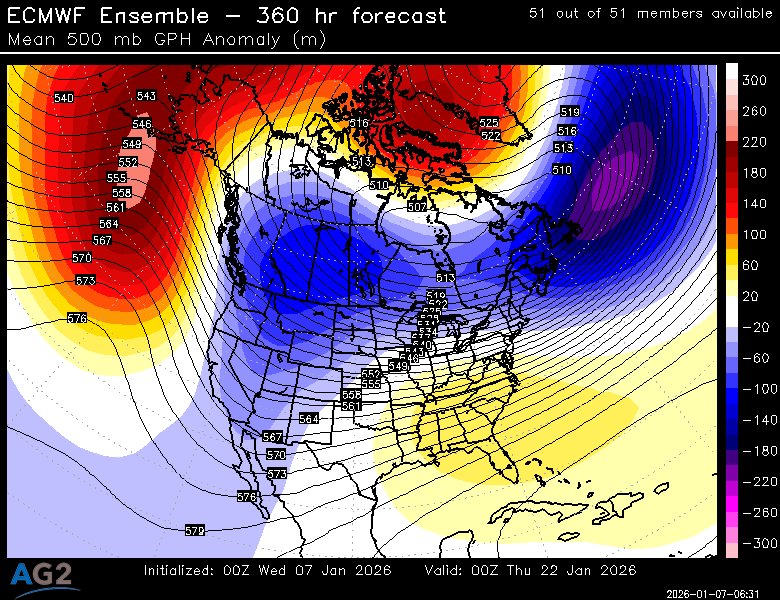

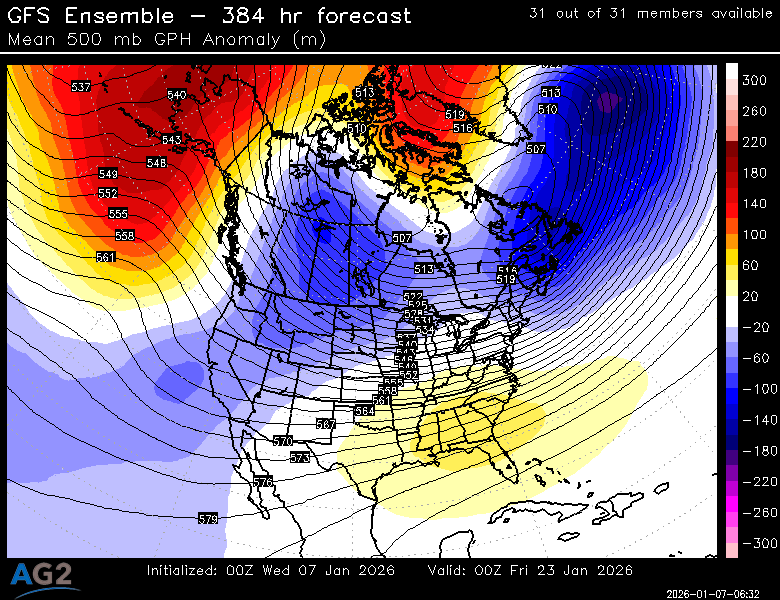

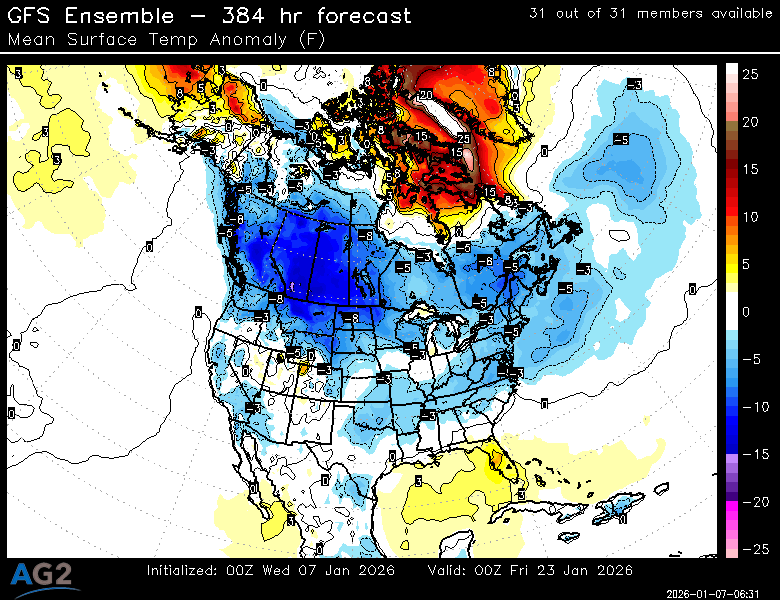

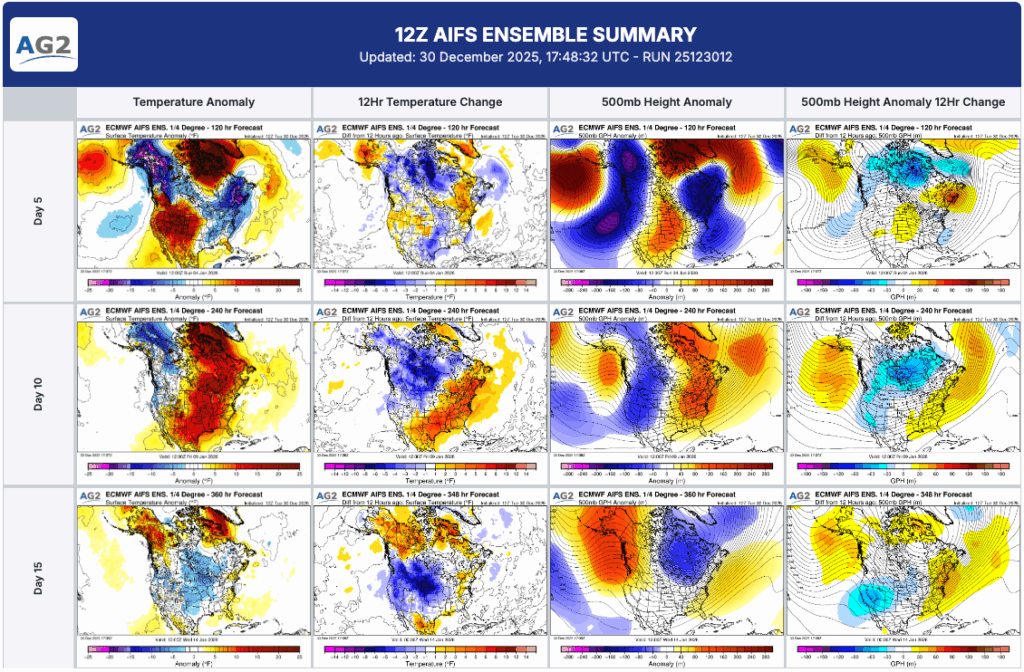

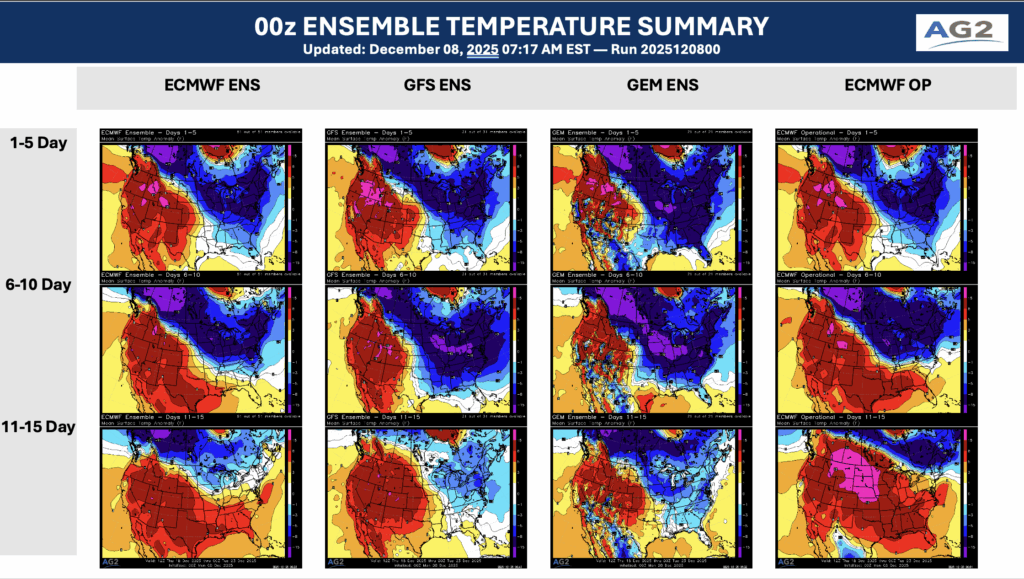

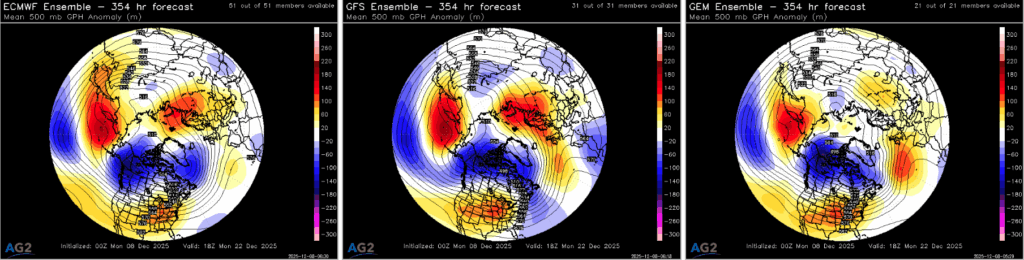

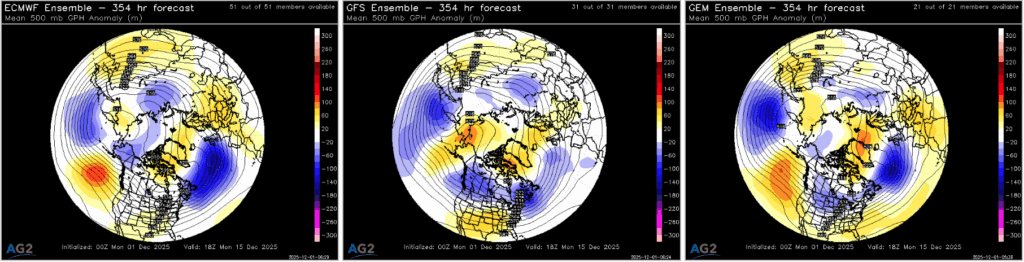

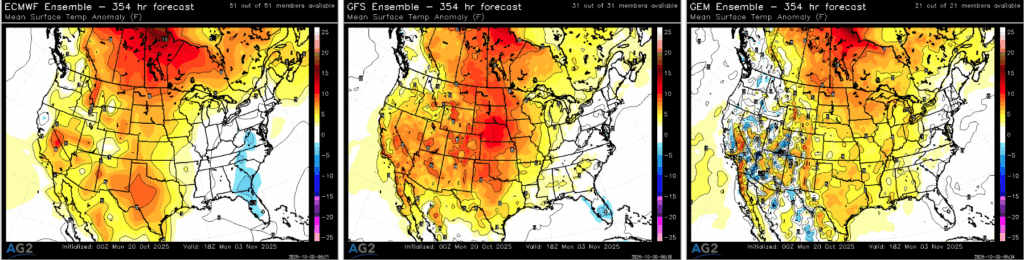

On day 15, the GFS ensemble mean, ECMWF ensemble mean, and ECMWF AIFS ensemble are all telling a very similar large-scale story at the 500 mb level, centered on a high-latitude blocking regime that favors a colder-than-normal North American background state. Each guidance set depicts a ridge building into Alaska, consistent with a negative EPO, which forces the jet stream to buckle downstream and supports colder air delivery into western and central portions of North America. At the same time, ridging extending across the high Arctic reflects a negative AO signal, reinforcing suppression of the polar vortex and allowing cold air to more readily dislodge southward.

Downstream, all three ensemble systems also indicate a ridge near or over Greenland, aligning with a negative NAO. This Greenland blocking helps slow the overall pattern and encourages troughing across eastern North America. The agreement on this triad of teleconnections (–EPO, –AO, –NAO) is notable at this lead time and lends confidence to the idea that the hemispheric pattern is supportive of sustained cold risks rather than transient shots.

Across the CONUS, the ensembles consistently show a positively tilted trough extending from the Pacific Northwest into the west-central United States. This orientation favors a broad cyclonic flow and continued access to colder air masses from western Canada into the Plains. Downstream of this trough, a Southeast ridge is evident, particularly in the ECMWF-based guidance, which acts as a partial brake on how far south and east the cold can penetrate at the surface.

Even with that Southeast ridging, the 500 mb pattern still supports the potential for colder air to push into the Mid-Continent and possibly as far south as Texas, especially if shortwave timing or surface pressure placement becomes more favorable. While the ensemble mean surface temperature anomalies currently show limited cold signal into Texas, the upper-level configuration suggests this is a credible forecast risk rather than noise. In other words, the mid-level pattern is colder than what the surface anomalies alone might imply, leaving room for colder outcomes should the blocking and trough alignment verify more aggressively.

This morning, we saw some significant colder moves in the latest 00z ECMWF ENS for next week. There is now lower confidence in the forecast next week as milder Atlantic air tries pushing in from the west, with the cold pool of air still in place across eastern Europe. Here we take a look at the details of this.

The population weighted temperature graph for Central Europe below shows the significant colder moves in the latest 00z ECMWF ENS. While the latest AG2 forecast lies closer to the 00z GFS ENS.

The large model spread and uncertainties next week are related to the models struggling in how intrusive milder air from the Atlantic will push in across Europe – a battle ground between a milder west and colder east, with Central Europe on the borderline between the two. FRisk graphics below clearly show that the lowest forecast risk (highest confidence indicated by green shading) next week is across the far west of Europe. While the highest forecast risk (red shading) and where we should expect forecast changes being across central and eastern Europe:

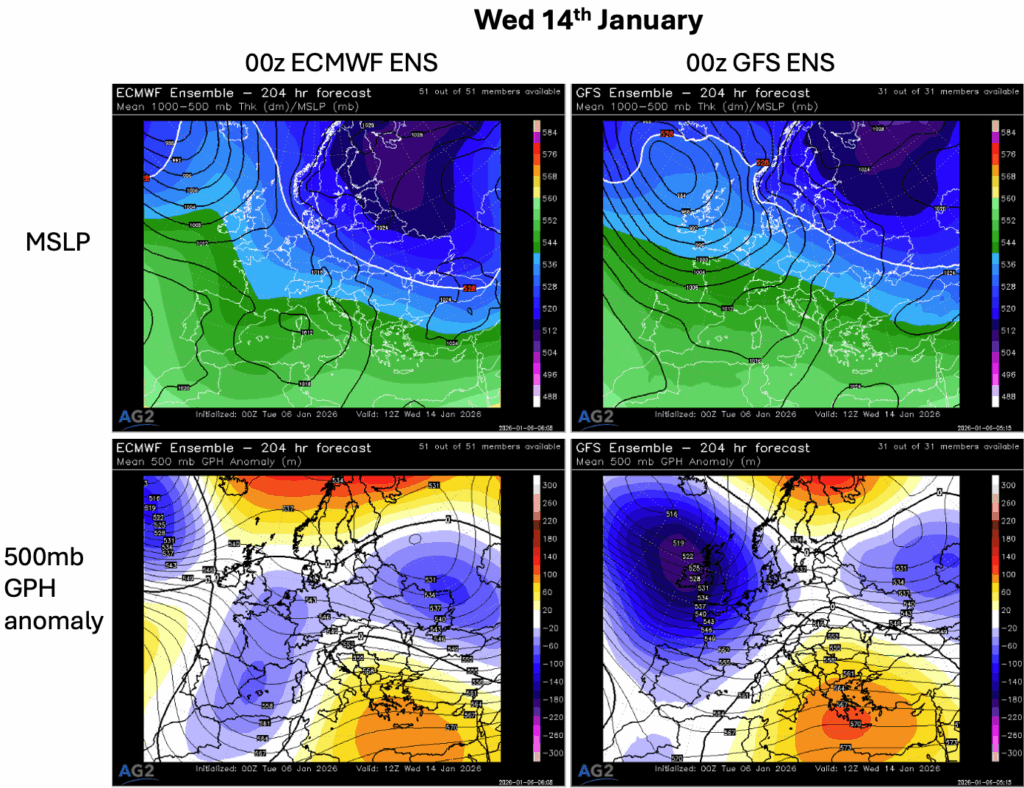

When we compare the latest 00z ECMWF ENS and 00z GFS ENS for next Wednesday, 14th January below we can clearly see the pressure pattern differences. With the GFS ENS bringing in deeper troughing the the north-west, this results in a stronger westerly airflow and hence milder air pushes further into Europe from the Atlantic causing temperatures to recover. Whereas the 00z ECMWF ENS forecasts a much weaker pressure pattern and hence the colder air holds on for longer due to a lack of a strong Atlantic airflow.

As a result, differences are also apparent in German winds next week. Alongside the colder moves in the latest 00z ECMWF ENS, associated lower wind moves for Germany:

When looking at the temperature clusters for the 6-10 day timeframe below, there are uncertainties in the exact details of that milder air pushing in from the west as discussed earlier. The top ECMWF cluster 41% is clearly the coldest solution holding onto the cold widely across northern, central and eastern Europe.

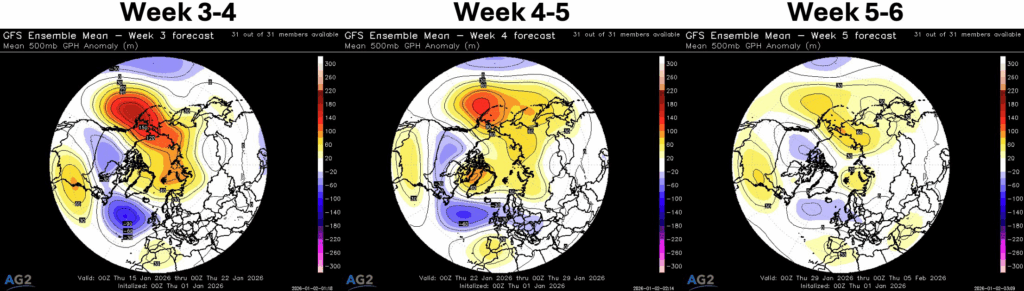

Sub-seasonal guidance keeps on pointing at a milder recovery later in January, linked to enhance Atlantic influence. This should favor wetter and windier conditions into NW Europe under troughing, but there is higher uncertainty on the extent of such into C Europe. Larger scale drivers provide weaker signals limiting somewhat forecast confidence late Jan into Feb right now.

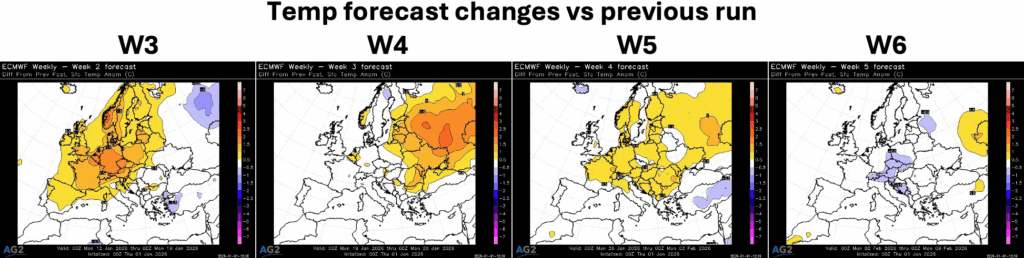

Looking at the latest EC weekly run, we find an overall milder forecast than its previous release, especially in weeks 3 and 5. Only slightly milder and more towards the NE W4, while slightly cooler across C Europe W6 eventually.

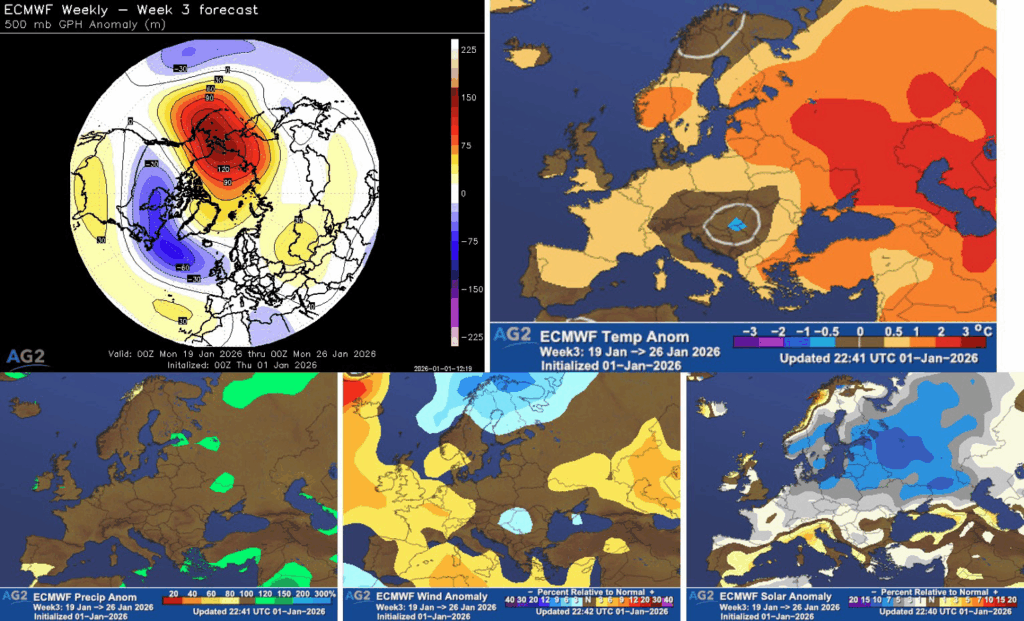

Let us get into a weekly breakdown of the latest solution, with regards to pattern, temps, renewables for Europe and what we think of those from the ensemble mean solution standpoint.

Calendar Week 4

- Pattern: Higher pressure is resolved through SW and NE areas of the continent, with deeper troughing NW, connecting through the C Med through shallower low heights.

- Temperatures: Widely milder than normal, if not nearer normal across C-E mainland Europe.

- Hydro: Very week signal, leaning somewhat wetter NW and into the Med, while drier far SW.

- Wind: Above normal C-W Europe, nearer normal E’wards.

- Solar: Overall cloudier than normal, except for slightly sunnier S Europe locally.

- Confidence/Risk: Expectations of milder weather are fair, with GFS weekly and main MJO wave supporting NW troughing, but the outburst of tropical convection over the Atlantic next week could have some repercussions in liming the warmth. Also, high uncertainty in the extent of troughing into C Europe based on poor clustering on that. Finally, not a fan of the weak precipitation signal – general shape is fine based on pressure pattern, but I would like to see more pronounced anomalies.

Calendar Week 5

- Pattern: Troughing to the NW extends into W Europe, while ridging from the NE protects E Europe more.

- Temperatures: Falling not too far from seasonal, but with a milder lean W a colder skew E. More pronounce warm anomalies are resolved to the NE and far SE peripheries of the continent.

- Hydro: Very week signal, but we can argue a slight wetter skew W and S, while drier NE.

- Wind: higher than normal NW, with lower the further S and E we move.

- Solar: Sunnier leaning signal, with cloudier conditions focused through Scandi and in some areas of the SE.

- Confidence/Risk: Decent confidence in main area of troughing staying NW, which limits any colder risks. The latter may however come from a weaker vortex. MJO signal is very week and washed-out by then and hard to hold on to it for any clearer guidance. Lower confidence on precipitation and solar, with the risk of wetter/cloudier W-SW and drier/sunnier NE-E.

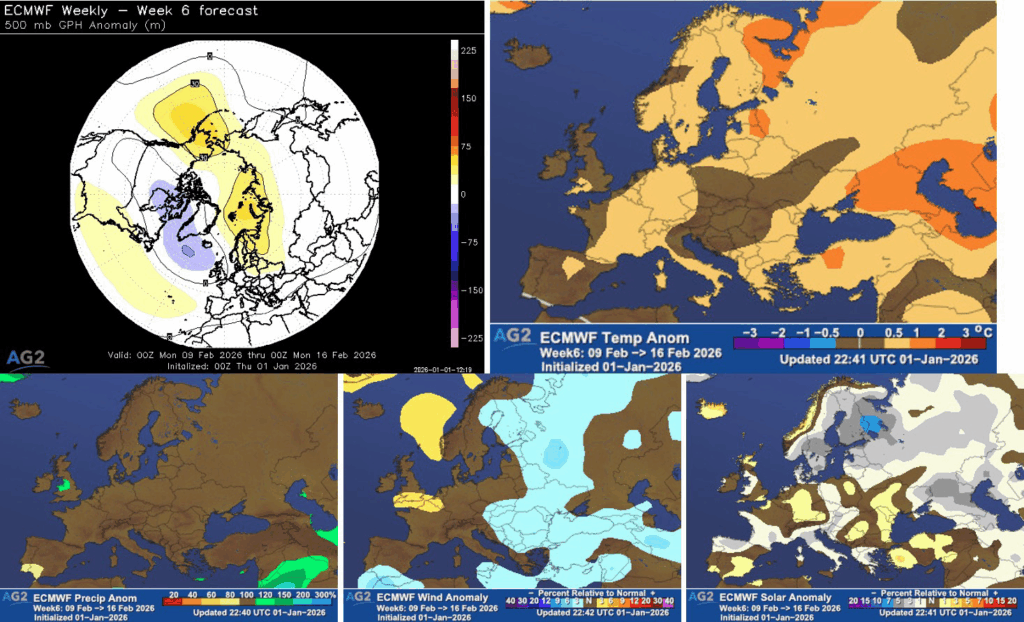

Calendar Week 6

- Pattern: Similar pattern as to what resolved for calendar week 4 above, over and around Europe.

- Temperatures: Skewed milder away from slightly colder C-E Europe.

- Hydro: Wetter signal SE, drier SW.

- Wind: Windier than normal NW, calmer through Iberia and E Europe.

- Solar: Sunnier W, cloudier E.

- Confidence/Risk: GFS weekly supports the idea that NW troughing sticks around, but EC46 clustering shows more volatility, suggesting lower confidence. Any colder, more blocked pattern could be aided by a weaker polar vortex, while little guidance can be found in the MJO forecast.

Calendar Week 7

- Pattern: NW troughing with higher heights S and E of it.

- Temperatures: Widely milder than normal.

- Hydro: Slightly wetter signal NW and drier SW, fairly coherent with the +NAO kind of look.

- Wind: Windier than normal NW, with lower wind further S and E.

- Solar: Weak, patchy signal.

- Confidence/Risk: Limited confidence on the persistency of NW troughing. Any colder risks could come from MJO (possibly increasing variability, yet not too clear at the minute), and/or a weaker polar vortex. Drier/sunnier risk through the mainland, especially S and E than currently resolved based on the pressure pattern alone.

GFS weekly

The latest GFS weekly aligns with the idea of lower pressure being to the NW of Europe, supporting less cold/milder expectations mid-late January. Only issue here is the rather stagnant pattern resolved throughout the GFS weekly solution – not necessarily too convincing.

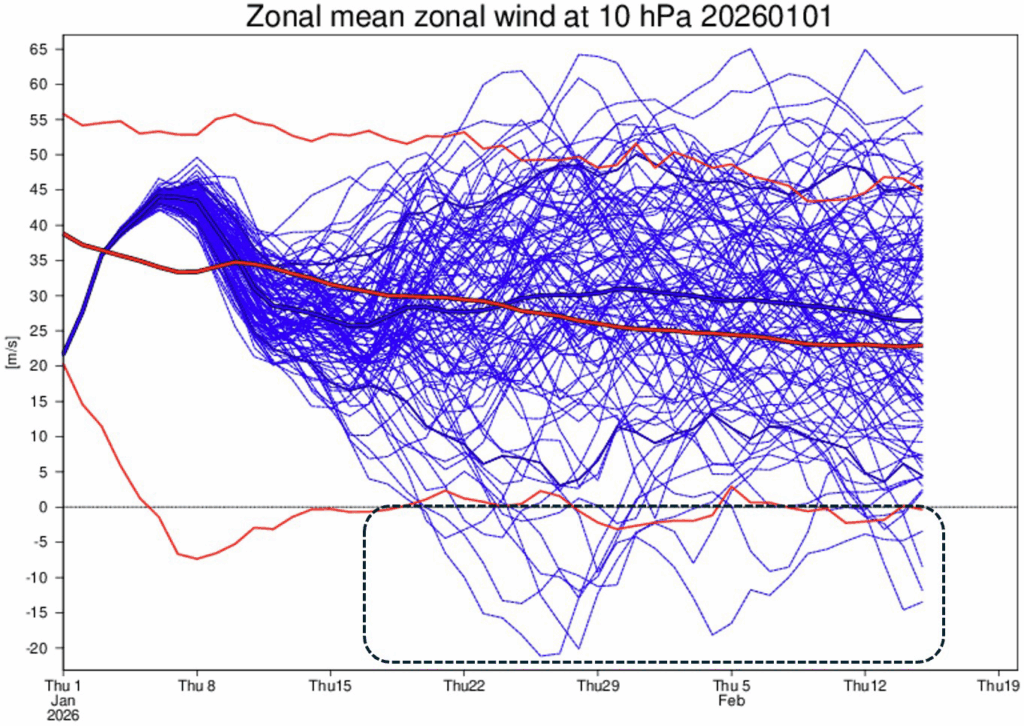

Polar vortex

The latest stratospheric polar vortex forecast shows a slightly weaker than normal vortex Mid-late Jan, shifting slightly stronger into Feb. There continues to be a large spread on both sides of the mean, with a handful of members continuing to drop into SSW territory late Jan into Feb. All of this makes for a very open forecast still with regards to the potential stratospheric influence on lower levels in particular.

MJO

The active MJO phase over the Maritime continent into the W Pac supports the recovery from more -ve NAO conditions next week, with the interference from tropical convection in the Atlantic limiting the rise of the NAO index towards mid-month. Further out though, we find a weak and washed-out MJO signal, providing limited guidance and little to hold on to in terms of forcing on the NAO and hence European weather just yet.

Bottom line: Sub-seasonal guidance continues to offer a milder picture through the back half of January with the development of lower pressure NW Europe, stimulating Atlantic flows. Wetter/windier conditions favored through NW Europe there, but with some uncertainty on their penetration into C Europe. Some risks of colder, or more variable patterns there and into Feb could come from larger scale drivers like MJO and SPV, but their extended-range forecast is highly uncertain at the minute, limiting forecast guidance. Milder end of Jan and Feb align well with broader seasonal expectations though.

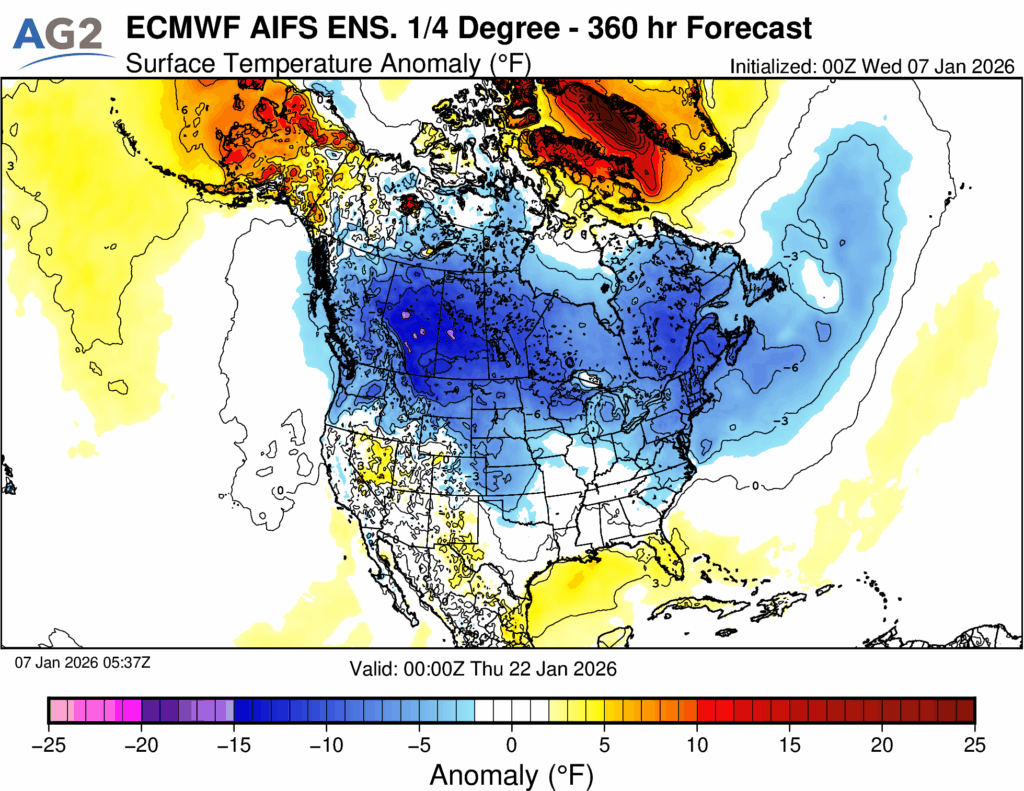

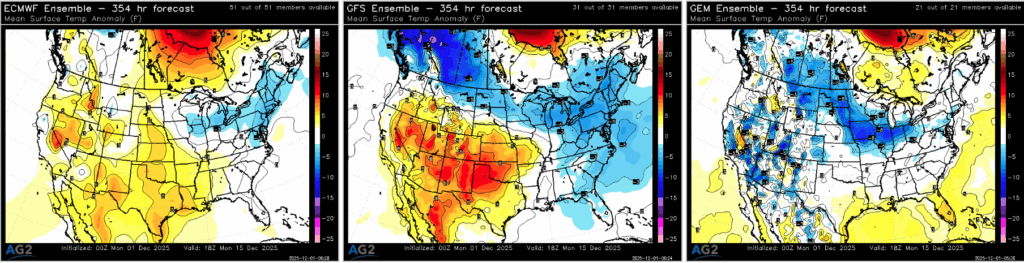

Based on the forecast image, the signal for a cold January in the U.S. is strongly tied to persistent Alaska ridging and a negative EPO look in the mid- to long-range. The 500 mb height anomaly panels show pronounced positive height anomalies centered over Alaska with corresponding negative height anomalies downstream across central and eastern North America, a classic configuration for sustained Arctic air delivery. This pattern forces the jet stream to dive south out of western Canada, allowing cold air to drain repeatedly into the Plains, Midwest, and East. The temperature anomaly and 12-hour change panels reinforce this setup, showing expanding below-normal temperatures spreading south and east with limited Pacific moderation. As the Alaska ridge remains anchored through Days 10–15, the cold source region stays replenished, increasing the likelihood of prolonged cold rather than brief shots. In January, this type of EPO-driven Alaska blocking pattern is especially effective at producing widespread, intense cold across much of the United States. Confidence is rising as models are coming into better agreement on mid-Jan cold outbreak.

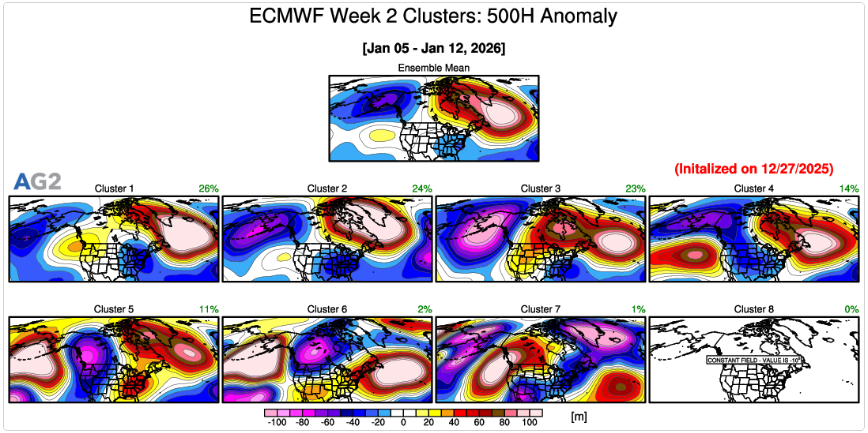

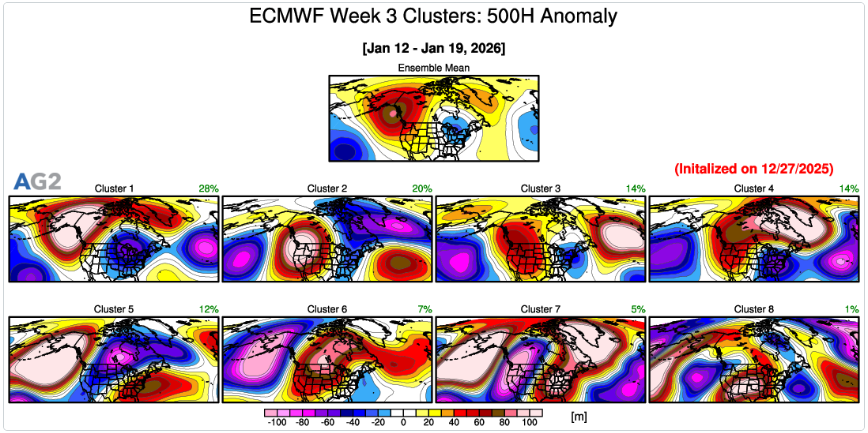

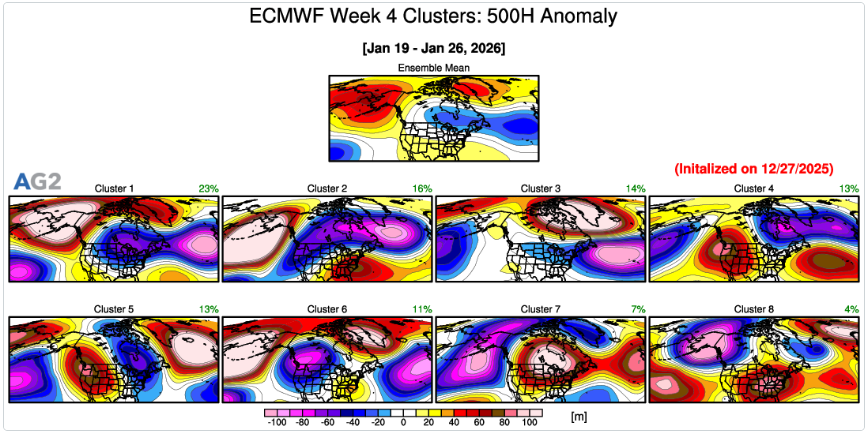

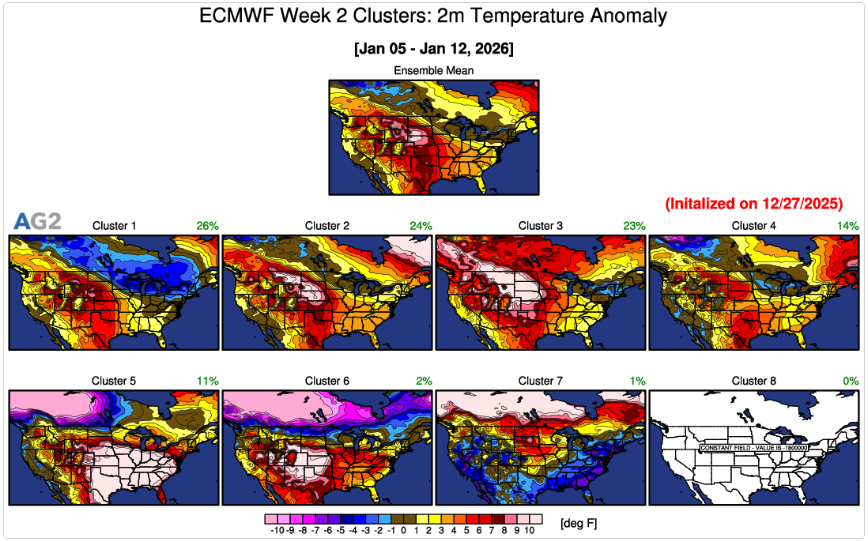

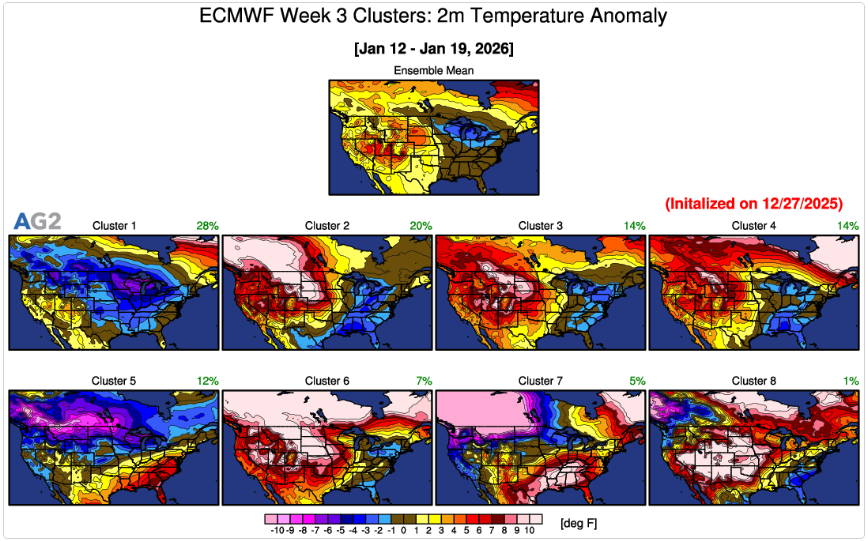

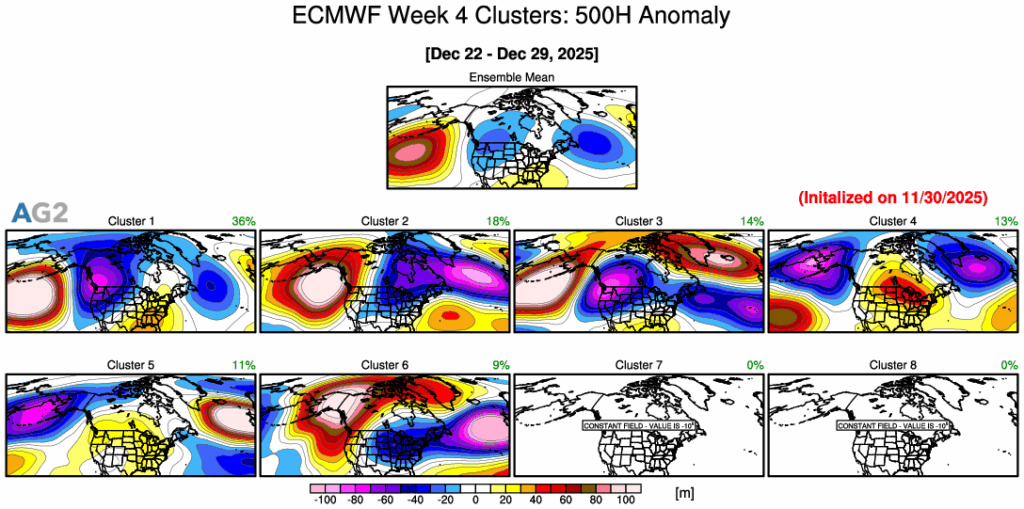

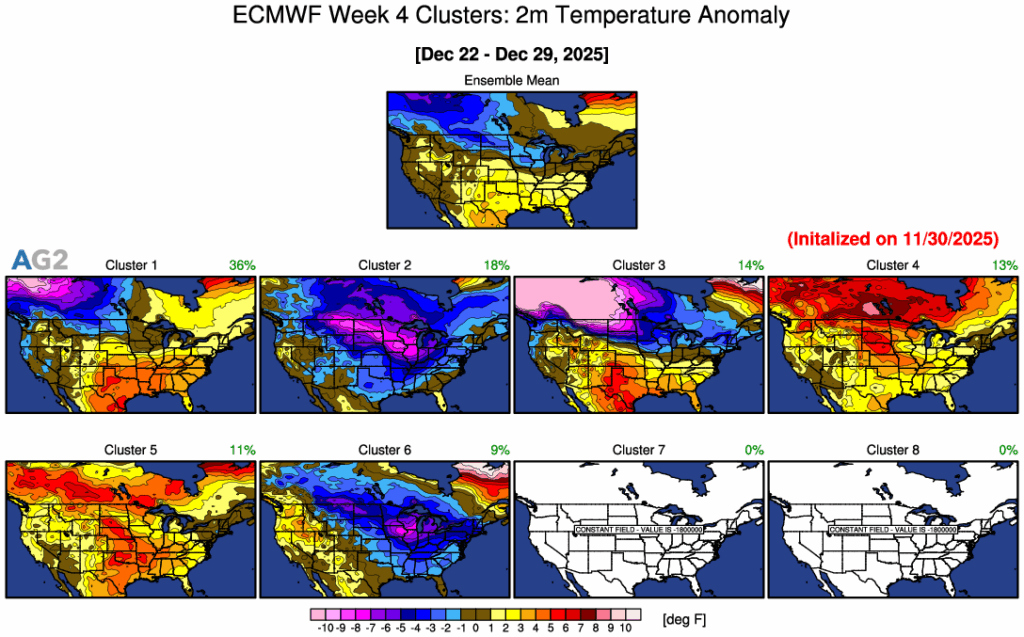

ECMWF Weeklies: Mid-January Pattern Evolution at 500 mb: The ECMWF weeklies signal a notable hemispheric shift as we move into mid-January, highlighted by strengthening ridging over Alaska and the higher latitudes of the North Pacific. Note the major change from Week 2 to Week 3 timeframe as the ensemble clusters increasingly favor positive 500-mb height anomalies centered over Alaska, with downstream troughing becoming more prominent across central and eastern North America. This configuration is a classic high-latitude blocking look, promoting cross-polar or Arctic air delivery into the CONUS. By Week 4, while cluster spread increases (as expected at longer leads), the persistence of Alaskan ridging in a meaningful portion of the solutions supports an elevated cold risk for the U.S., particularly east of the Rockies. The overall evolution points toward a more amplified flow regime, with reduced Pacific moderation and a greater likelihood of sustained cold intrusions rather than brief, transient shots.

Surface Temperature Anomaly Evolution: At the surface, the temperature anomaly clusters evolve in a way that coherently reflects the upper-air pattern. During Week 2, warmth dominates much of the central and eastern U.S., consistent with still-limited high-latitude blocking and a relatively progressive flow. As the Alaskan ridge strengthens into Week 3, colder anomalies begin expanding southward from Canada, especially across the northern Plains, Midwest, and eventually the East, while warmth becomes increasingly confined to the southern tier and parts of the West. By Week 4, several clusters depict widespread below-normal temperatures across large portions of the U.S., signaling a higher probability of a colder-than-average regime becoming established. While not every solution is uniformly cold, the trend toward broader negative temperature anomalies aligns well with the growing influence of high-latitude blocking and reinforces the idea that mid- to late-January carries an increased risk for impactful cold across the CONUS.

The 12 day national demand change since Friday is +5.0 HDDs…

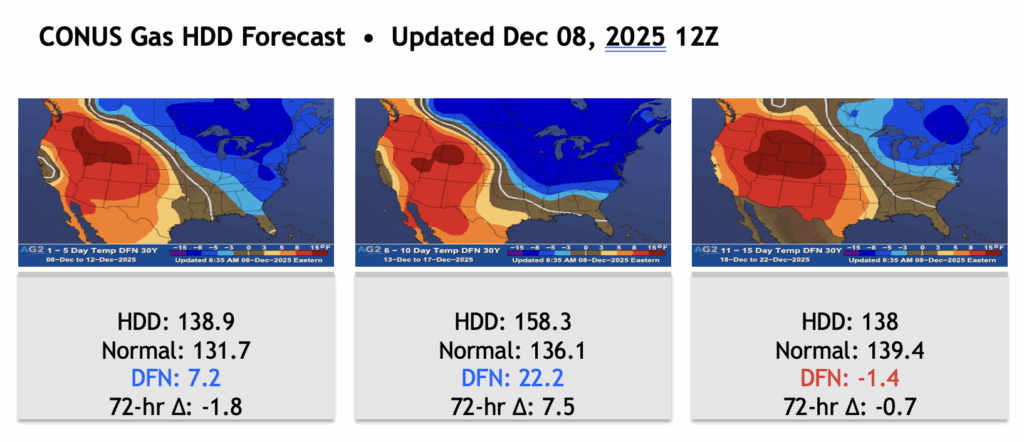

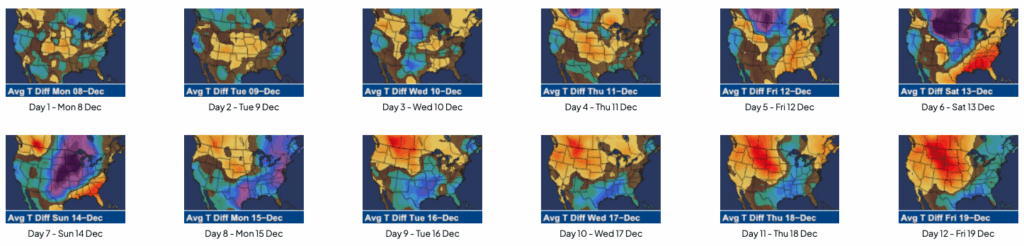

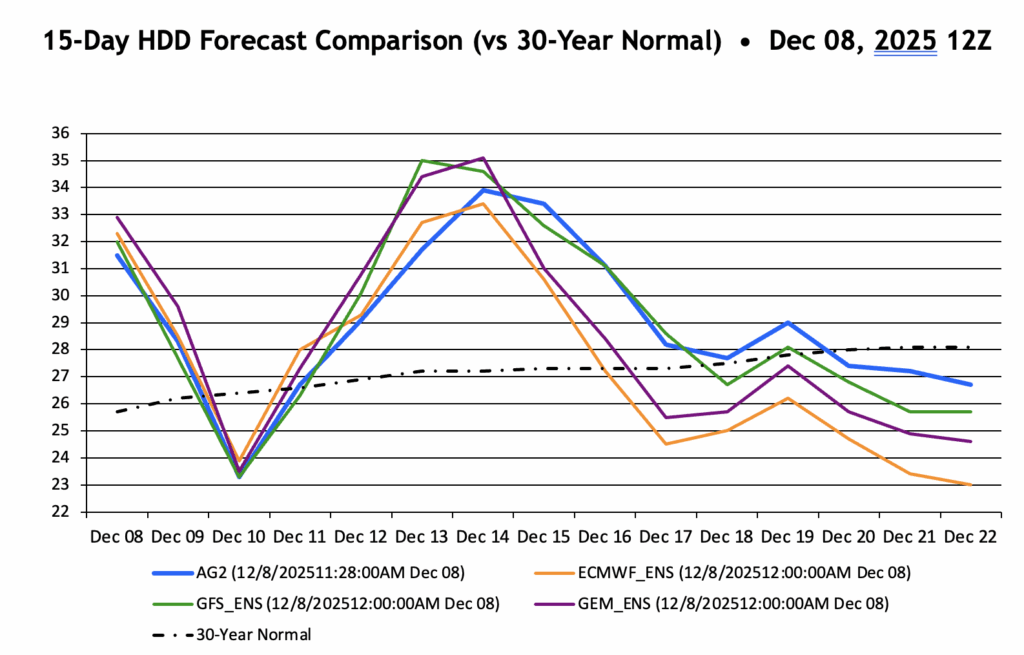

Modeled temperature anomalies for the next 15 days are below. Cold peaks in the next 5-7 days in the Midwest and Northeast with multiple 30+ HDD days expected. The 11-15 day offers a contraction of the cold into the Northeast, allowing the south and MidCon to warm up, but the Midwest and Northeast still look quite cold.

Texas really does not get into this extreme cold, with all models agreeing the worst is north and east of there for the most part through the 15 day period…

Our period maps are below noting mixed changes through the 15 day period versus Friday, highlighted by the 6-10 day trending colder.

Changes since Friday, by day, are below for the next 12 days.

HDDs remain above the 30 year normal through the next 10 days except for around Dec 10. Modeling trended warmer in the 11-15 day since Friday – also note we are colder than all models in the 11-15 day, partially due to AI guidance being colder currently.

A lot of these HDDs are driven by the Chicago->NYC corridor being as cold as it looks to be in these locations.

Looking at day 15, December 22nd, there remains colder risk in the Northeast, but most of the CONUS is warming up. The cold source remaining in western Canada is also getting scoured out. With ridging vacating AK, we may be entering the “rebound” portion of this pattern evolution, with warmer temperatures returning to the MidCon.

Our DEC HDD number is up to 891.5 HDDs – a fair envelope is 870-910 HDDs (30 year normal 840, 10 year normal 771).

Below we can see the expected VP200 forecast from the ECMWF and GFS weekly models. Notice both have a fast moving area of upward moving circumnavigating the globe currently, then again between 5-15 December. This promotes changeable conditions, but coupled with an active MJO and the recent stratospheric activity, there certainly is evidence for this colder pattern to linger into the 16-30 day.

The end of the 15 day forecast, around December 15th, is right in between these two CCKWs – the result is a “slightly” milder start to the week of the 15th as a ridge tries to build in the Southern Tier.

However, if the CCKW forecasts above are to be believed, there may be more choppiness into the week of the 22nd, versus a straight up warming trend. The ECMWF weekly clusters for Dec 22-29 are certainly mixed – plenty of bullish solutions, but the top cluster (36%) is much warmer in the East.

Bottom line: the MJO and fast moving CCKW’s are making us think the colder pattern we are enduring may linger deeper into December, with day to day variations of course expected…

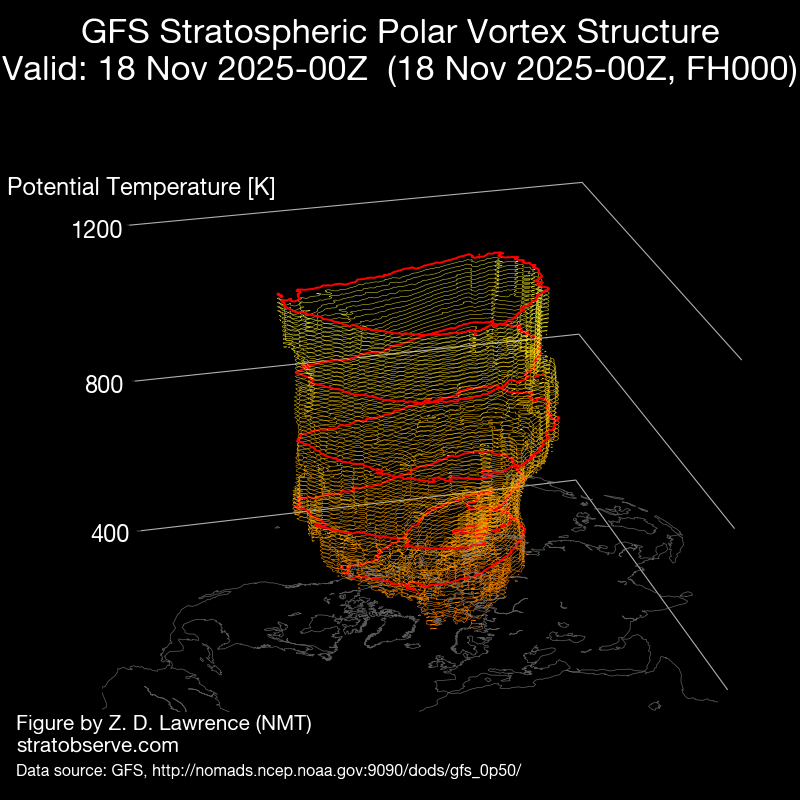

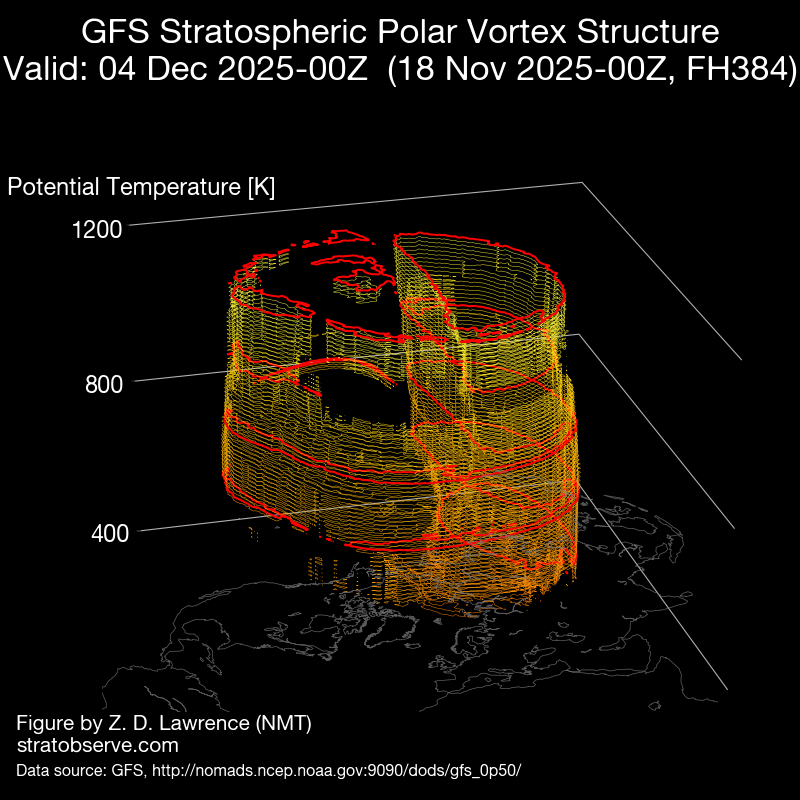

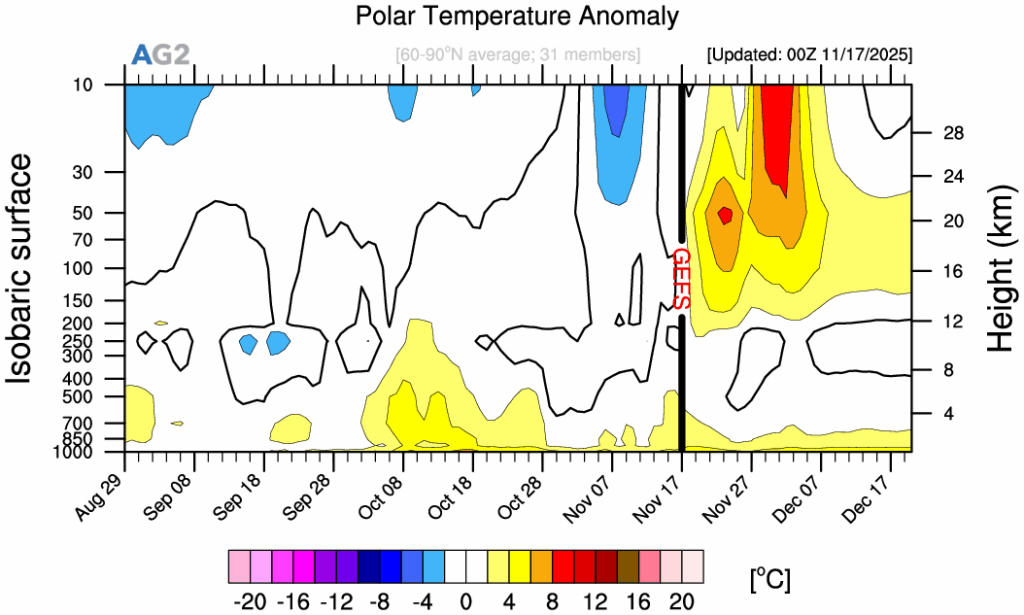

These two GFS 3-D forecasts suggest a meaningful weakening and distortion of the stratospheric polar vortex heading into early winter, which can carry important implications for mid-latitude weather. The first image, valid 18 November 2025, shows a fairly coherent, vertically aligned vortex structure that matches what is usually seen during a stable early-winter polar night jet. By the second image, valid 4 December 2025, the vortex becomes much more elongated, fractured, and vertically disrupted, with clear splitting tendencies and signs of stronger wave activity pushing into the stratosphere. Such deformation often precedes further weakening or even a mid-winter warming event, and if this trend were to continue, it would raise the odds of a negative Arctic Oscillation pattern later in the season, which is typically linked to colder, more disrupted winter weather in the mid-latitudes.

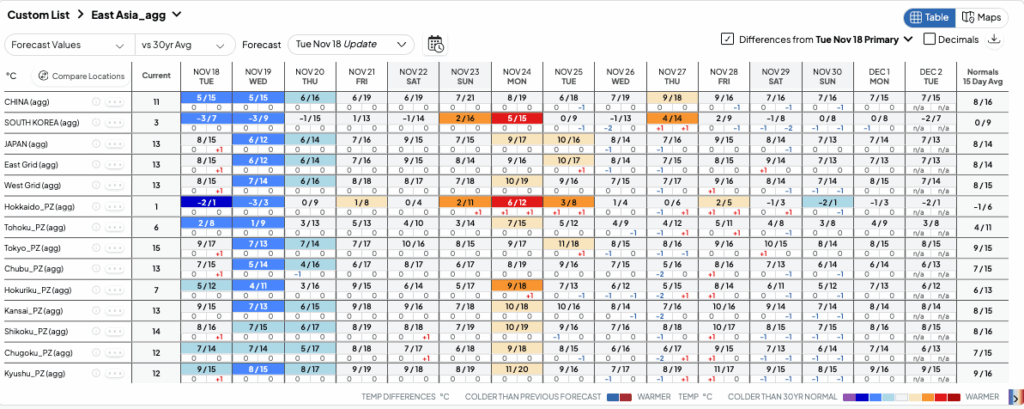

Temperatures across much of East Asia are expected to remain below normal through November 20. Along the Sea of Japan side of Japan, some low-elevation areas may see their first snowfall in the coming three days.

From the 21st onward, most forecasts indicate near- to slightly-above-normal temperatures, and model agreement remains high through November 24.

However, after November 25, model spread increases sharply, and FRisk highlights a significant temperature fluctuation risk.

Day 11–15 500mb GPH anomalies show substantial uncertainty in the position and depth of ridges and troughs.

Warm colors indicate ridges (anticyclonic), and cool colors indicate troughs (cyclonic). Cold-air outbreaks typically occur west of a trough or east of a ridge.

ECMWF and GEM place the trough axis broadly from northern China to Japan, while GFS exhibits much greater ensemble spread, underscoring higher uncertainty.

Thus, China, Korea, and Japan are likely to shift toward colder revisions during this period.

The latest ECMWF AIFS further suggests that a trough may stall from northern China to Japan between Nov 29 and early December, likely due to a blocking ridge near the Aleutians.

This scenario raises the potential for a prolonged cold spell beginning around Nov 29, with implications for heating demand and energy markets.

Stratospheric Sudden Warming (SSW) May Reinforce Cold Risks

Signals of a possible SSW event strengthen the case for late-November cold.

An SSW occurs when the stratospheric polar region warms abruptly, weakening or reversing the polar night jet. This can disrupt the tropospheric jet stream, increasing the likelihood of cold-air outbreaks in mid-latitudes.

Forecasts of 10 hPa zonal winds at 60°N show ensemble mean winds turning easterly around Nov 27, with increasing spread afterward—consistent with rising SSW uncertainty.

Stratospheric temperature anomalies at 10 hPa also show warming beginning around the same time.

Negative Arctic Oscillation (AO) Adds to the Risk

The AO index is forecast to turn negative after Nov 23, with many members remaining negative into early December.

A negative AO weakens the polar vortex and allows Arctic air to spill southward more easily, increasing the likelihood of cold outbreaks in East Asia.

In short, the period from late November into early December carries an elevated risk of a significant and potentially prolonged cold spell, with likely impacts on heating demand and energy supply balance.

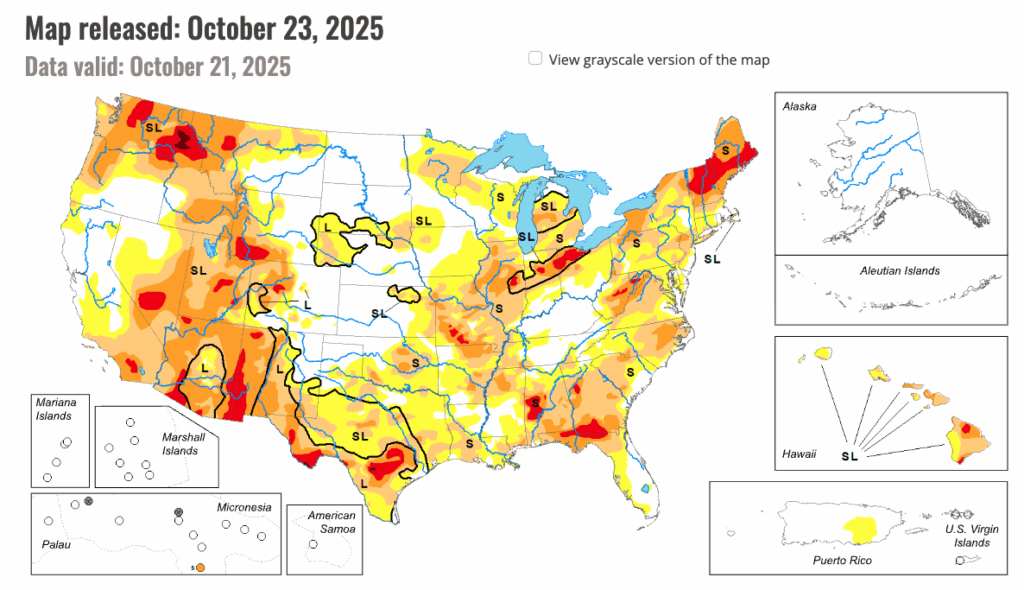

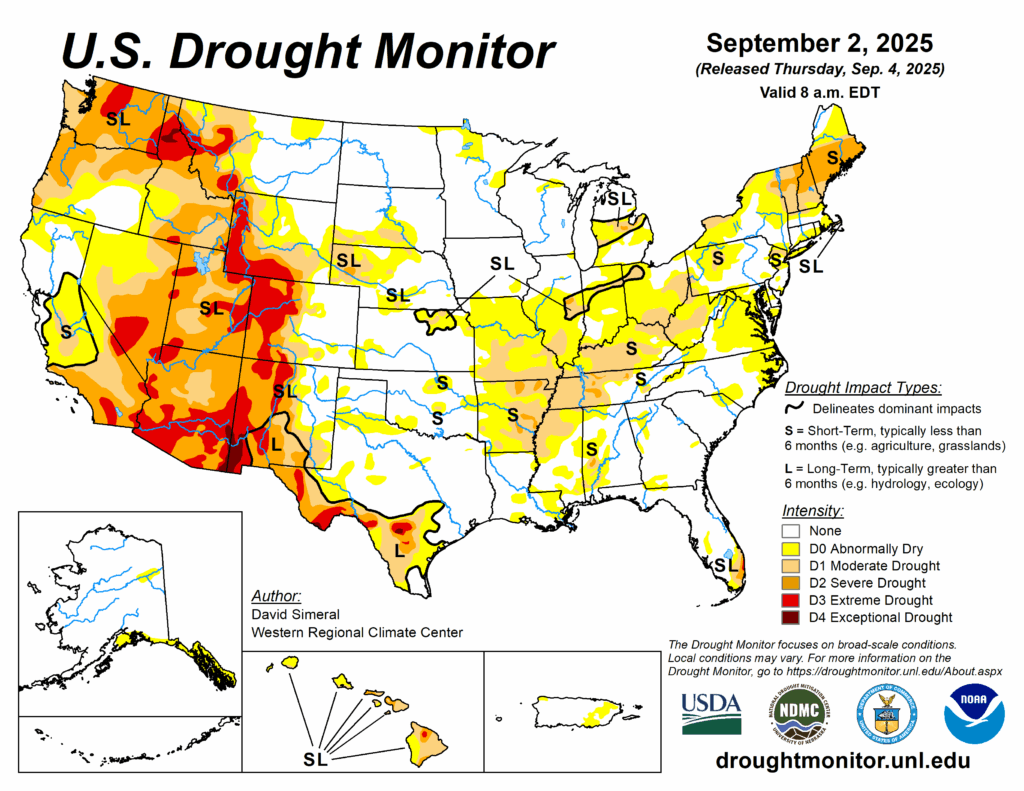

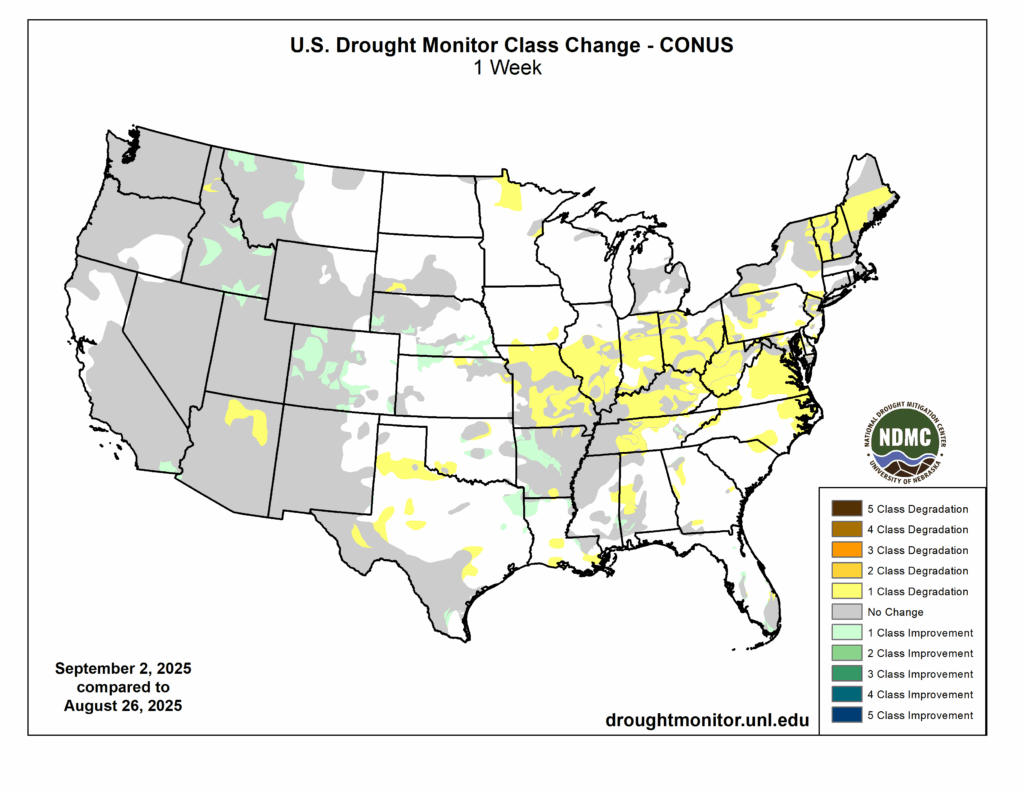

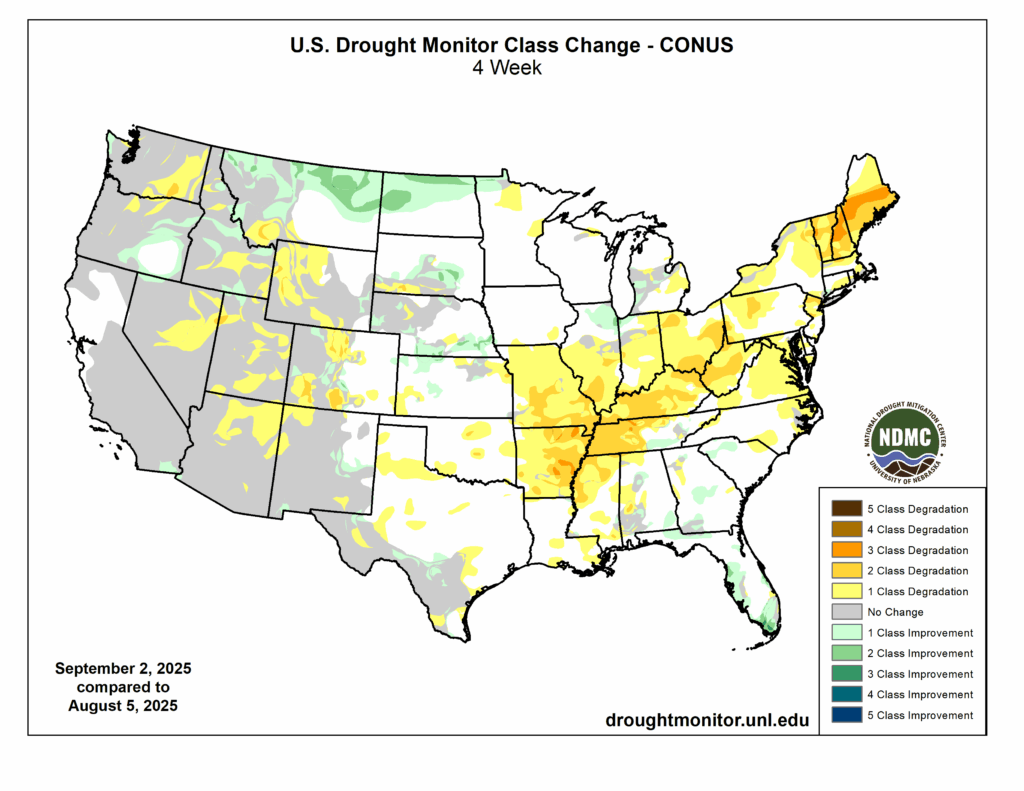

This blog takes a look at the latest drought monitor, which was issued this morning, October 23rd.

The latest drought monitor is below, noting drought coverage is down to 72.12% (down from 74.04% last week).

Week over week and month over month change maps are below. The most notable trends in the last month are wetter in parts of the Interior West, Rockies, and along the Ohio River, but drier in parts of Texas, the southern tier, Upper Midwest, Great Lakes, and East…

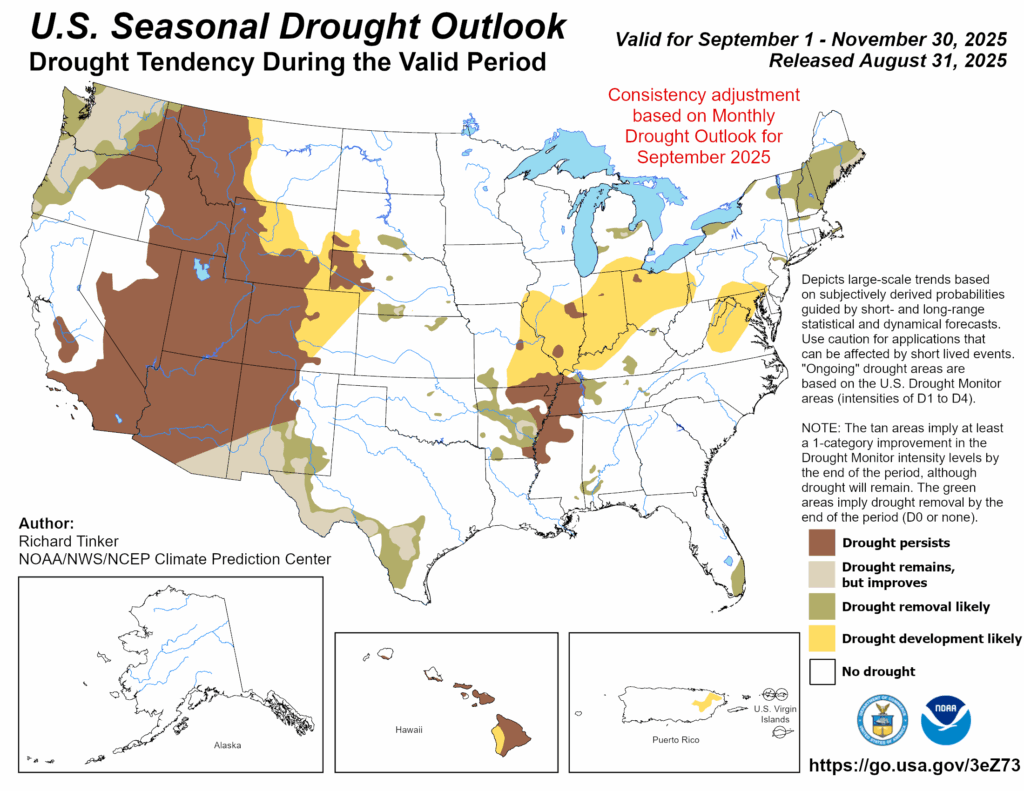

The forecast over the next 15 days is quite wet across the PNW as well as across the southern tier and along the East coast. It looks drier across much of the Upper Midwest and Southwest over the next 15 days relative to normal.

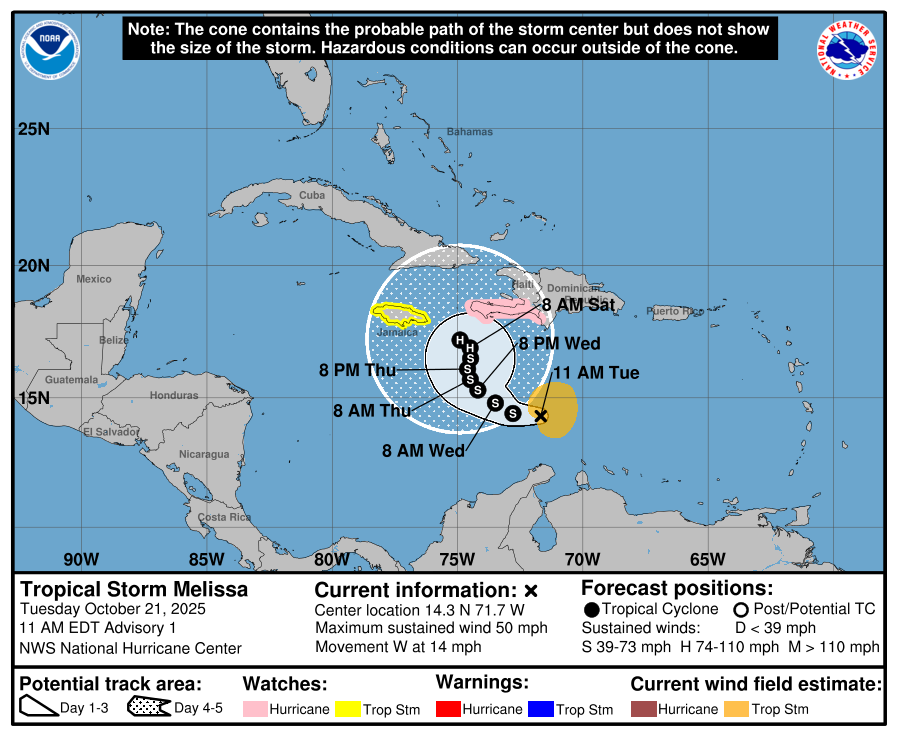

Tropical Storm Melissa formed this morning almost halfway between Aruba and Hispaniola. It will slowly meander northward and may become a hurricane by this weekend. NHC track is below.

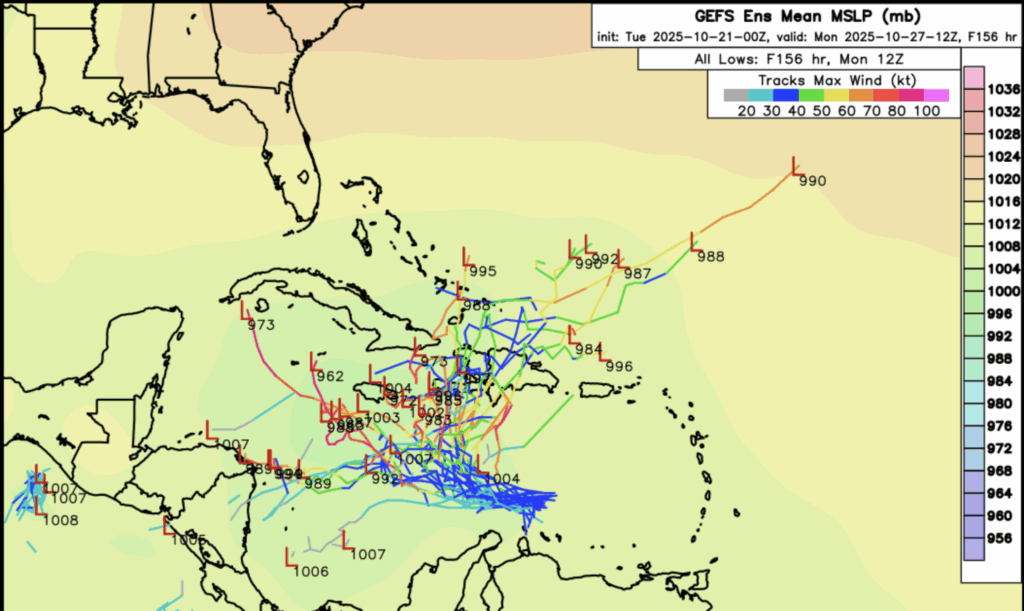

Model solutions remain very uncertain regarding the track of this system. The GFS and ECMWF model member tracks are shown below, noting really no member gets close to the U.S. through early next week.

However, eventually this system will catapult northeastward in due time. Notice the same model members above now spread out the late next week show a similar idea with Mellisa ejecting northeastward over Hispaniola or Cuba, then east of the Bahamas. Florida should continue to monitor this system.

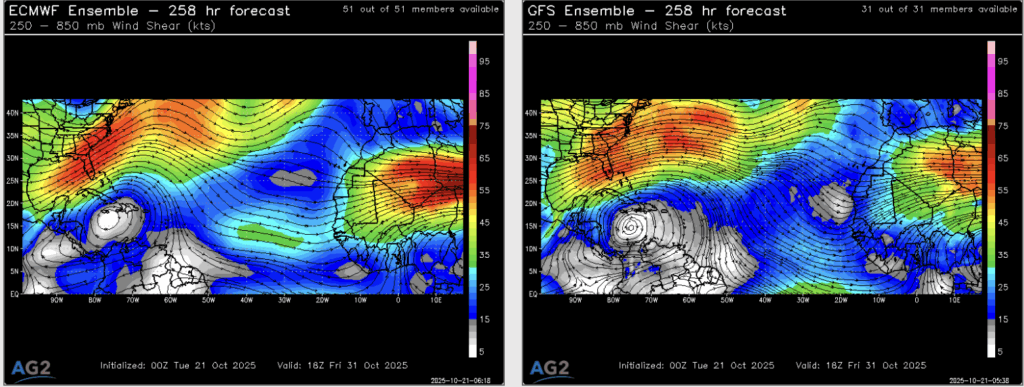

Wind shear looks very strong behind a cold front closer to the U.S., so the risk for a direct hit is low at this time. More to come…

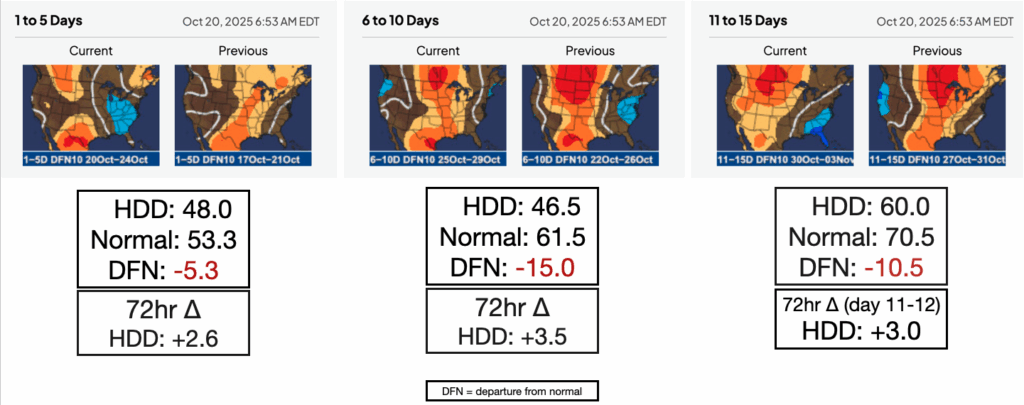

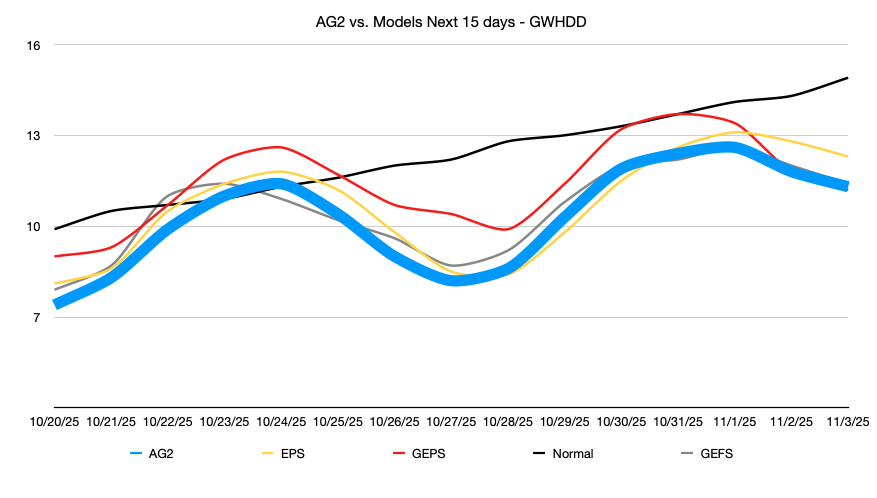

The 12 day national demand change since Friday is +9.1 HDDs…

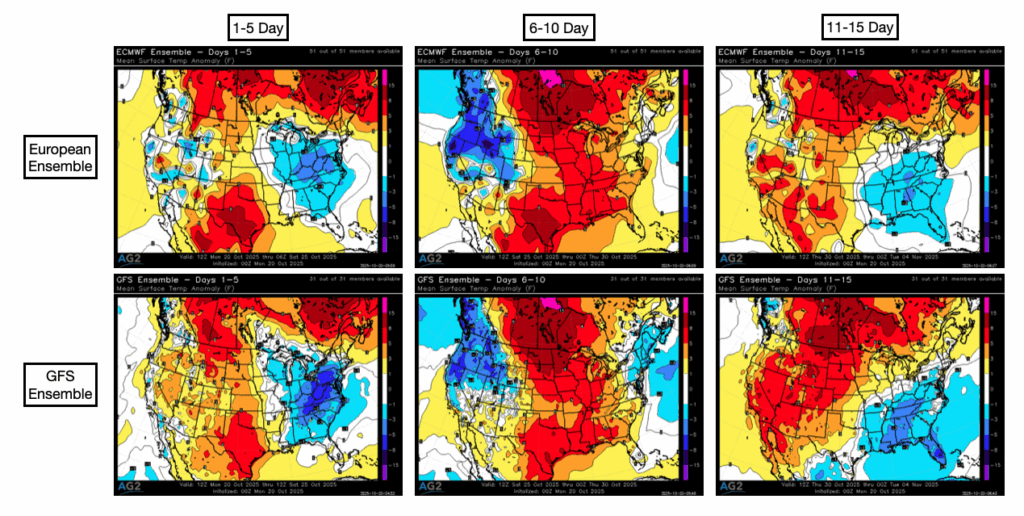

Modeled temperature anomalies for the next 15 days are below, noting some chill this week in the East, a very warm 6-10 day, and more eastern chill in the 11-15 day.

Our period maps are below noting cooler changes in all periods since Friday, especially in the East.

Changes since Friday, by day, are below for the next 12 days.

HDDs remain below normal throughout the period, despite recent cooler weekend changes. A testament to the +EPO we are experiencing…

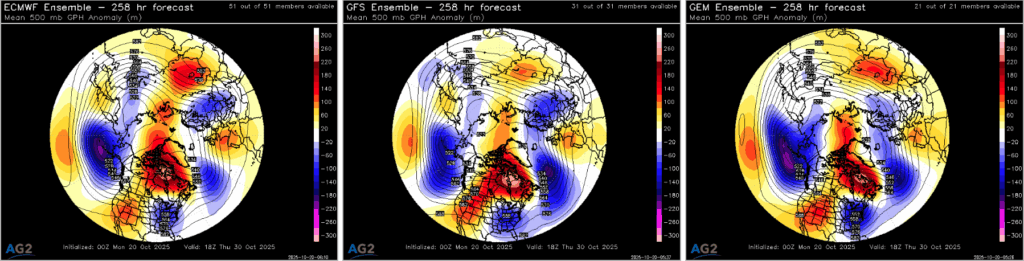

By day 11, October 30, we see a lingering -NAO, but the N Pacific pattern has a lot of troughing (+EPO), which is still not conducive to a widespread cold outbreak. Regardless the pattern does look to cool down a bit in the East thanks to an incoming trough.

Not a lot of cold to work with in the source regions in Canada, so the risk here remains limited for anything widespread or durable in terms of cold.

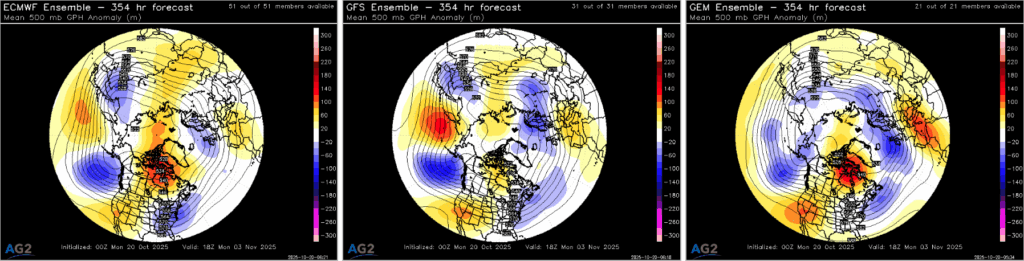

By day 15, November 3, we can see that trough moving east, with ridging slowly returning to the MidCon. Notice the north Pacific is not as trough-y, but still not overly conducive to widespread early season cold…

Not a cold pattern…

Not a ton of support from the week 3 ECMWF weekly clusters for cold through that week of November 3, either, with only 22% of members truly offering something meaningful. Will continue to watch the mid-November pattern…

Super Typhoon Ragasa is currently tracking west-northwest across the northern Philippines and into the South China Sea, with sustained winds exceeding 130 knots at peak intensity. Forecasts from the Joint Typhoon Warning Center show it maintaining super typhoon strength as it approaches the southern China coastline near Hong Kong and Guangdong around September 24, before weakening over northern Vietnam. This trajectory takes it directly across one of the busiest LNG shipping corridors in Asia. The South China Sea is a vital route for cargoes coming from Australia, Qatar, and Southeast Asia heading to key buyers such as China, Taiwan, and Japan, and the presence of such an intense system will force LNG carriers to reroute, delay sailings, or idle at safer anchorage points until the storm passes.

Operationally, ports and LNG import terminals in southern China—including those near Shenzhen, Zhuhai, and Hong Kong—are likely to halt activity temporarily due to safety concerns, which could delay offloading and disrupt short-term scheduling. This creates a cascading effect: charter rates may rise, congestion could build up at alternate ports such as Singapore or Subic Bay, and some buyers may face short-term supply tightness. From a market standpoint, the disruption risk adds upward pressure to spot LNG prices, especially in a period of already high seasonal demand. Even if the storm weakens before final landfall, its broad wind field and heavy seas will still impact vessel operations in the region for several days.

As of September 2, 2025, the U.S. Drought Monitor shows that drought conditions remain a major concern across much of the country, with particularly severe impacts continuing in the Southwest. Large portions of Arizona, Nevada, Utah, and New Mexico are in Severe to Extreme drought, with pockets reaching Exceptional drought levels. California is also experiencing widespread Moderate to Severe drought, especially inland, while parts of Idaho and Oregon are struggling with Extreme drought, threatening water supplies and ecosystems. In contrast, the Midwest and Plains display a mixed picture, with broad areas classified as Abnormally Dry to Moderate drought, though some localized improvements have been noted. The Northeast and Mid-Atlantic are showing signs of short-term drought stress, particularly in Maine, New York, and Pennsylvania, while the Southeast continues to deal with scattered Severe drought.

Comparing conditions to just one week earlier, from August 26 to September 2, several regions saw notable shifts. Parts of the Mid-Atlantic, Southeast, and Texas experienced one- to two-class degradations, signaling rapidly worsening drought stress. However, improvements occurred in the Northern Plains, Rockies, and sections of the Pacific Northwest, where recent rainfall has provided some relief. Overall, much of the country remained stable with little change, but the areas of worsening drought highlight how quickly conditions can deteriorate in the late summer season.

Looking back over the past four weeks, the broader trend underscores both the persistence and expansion of drought in many regions. While some improvement is evident in the central U.S. and the Northern Rockies, widespread degradation has occurred across the Northeast and Mid-Atlantic, where drought has intensified over the past month. The western U.S. continues to carry the deepest and most persistent drought, with long-term impacts to water availability, agriculture, and ecosystems. As we head further into September, close monitoring will be critical, as short-term weather shifts can either intensify drought conditions or provide much-needed relief.

The seasonal drought outlook for September through November 2025 offers both challenges and cautious optimism. Across much of the Southwest and interior West, drought is expected to persist through the fall, with only limited improvement likely. In contrast, parts of the central U.S., including portions of the Southern Plains and Mississippi Valley, show potential for at least some improvement in drought intensity, though not full recovery. Encouragingly, sections of the Midwest and parts of the Southeast are expected to see drought removal by the end of the season if forecast rainfall materializes. However, new areas of concern are emerging, with drought development likely across portions of the Ohio Valley and mid-Atlantic, suggesting that late summer dryness could evolve into longer-term issues. Overall, while the seasonal outlook points to gradual improvement in some regions, the entrenched drought in the West remains the most persistent and concerning feature of the national drought landscape.

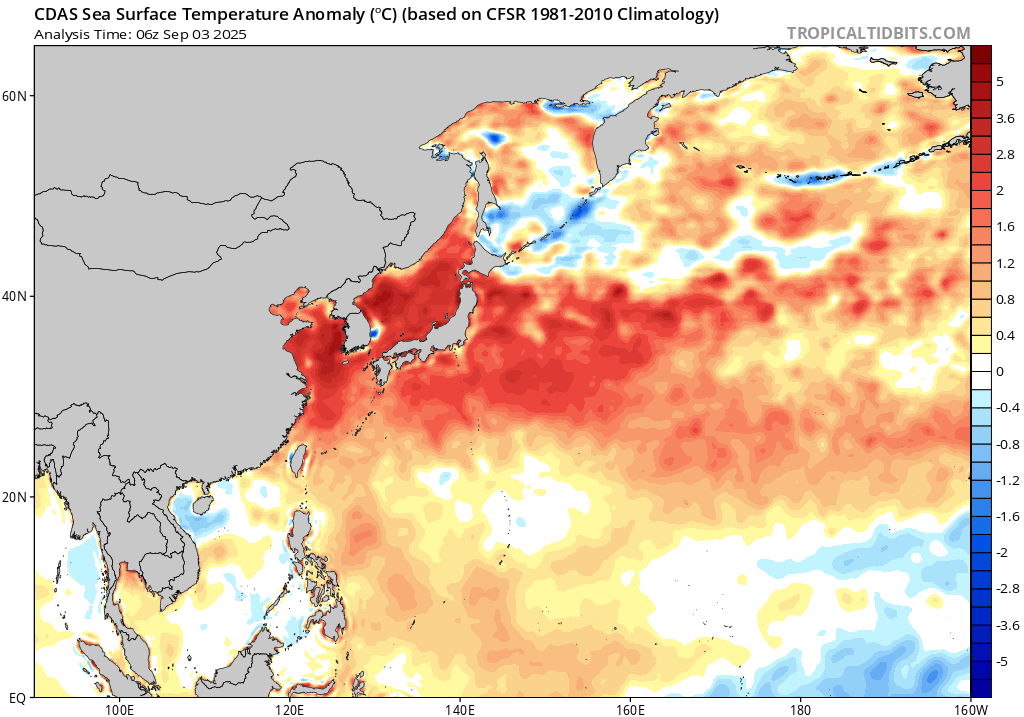

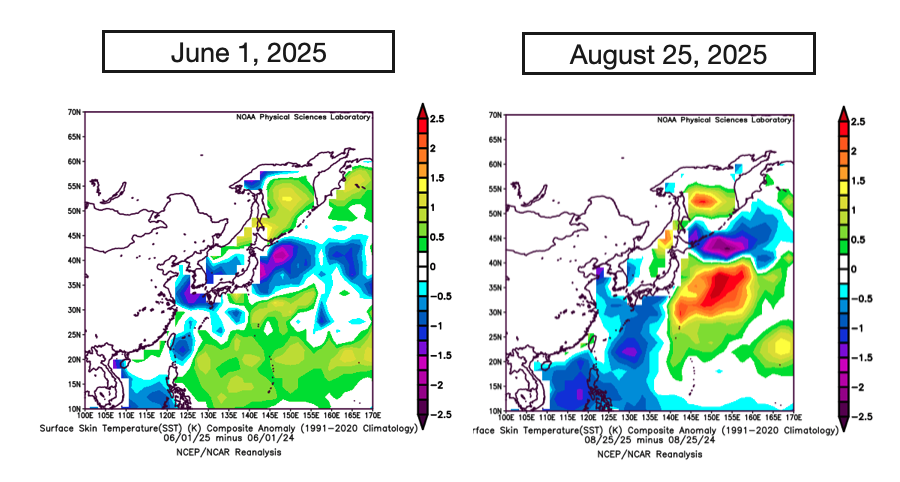

Asia had yet another hot summer, with population centers from eastern China to Korea to Japan all recording very impressive temperatures. This was driven by both the neutral to weak La Nina ENSO conditions as well as the anomalously warm SSTs adjacent to eastern Asia. We can see the impressive SST anomalies below, with most areas 2-3°C above the 1981-2010 normals.

Comparing SSTs from 2025 to 2024, we can see early in the season (left) much of the water southeast of Japan was warmer than 2024 (warmer colors) while the Yellow Sea was cooler than 2024 (cooler colors). This largely continued through the season, with waters near Tokyo significantly warmer in 2025 versus 2024.

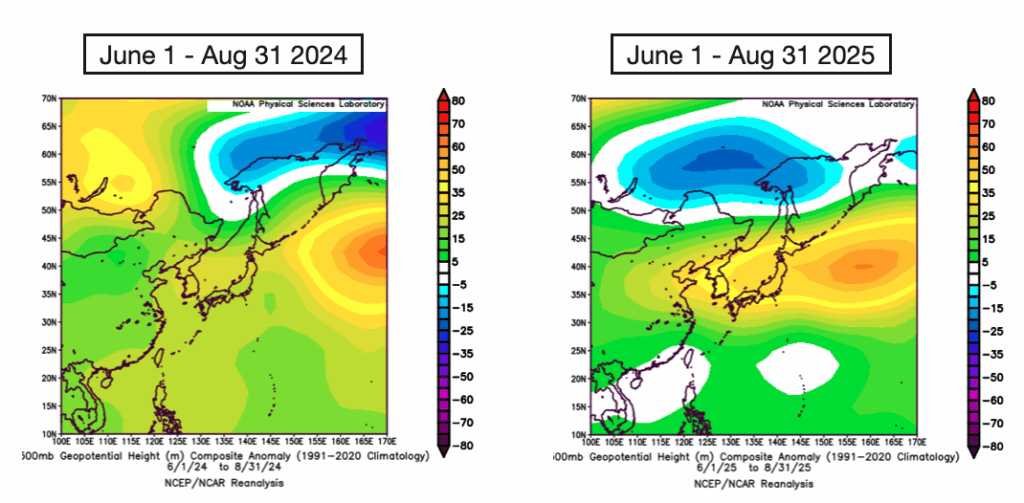

Looking at the upper level pattern, we can see the ridge (warmer colors) was actually stronger in 2025 over Japan and Korea compared to 2024. Both years had a bunch of ridging which supported all the warmth we witnessed.

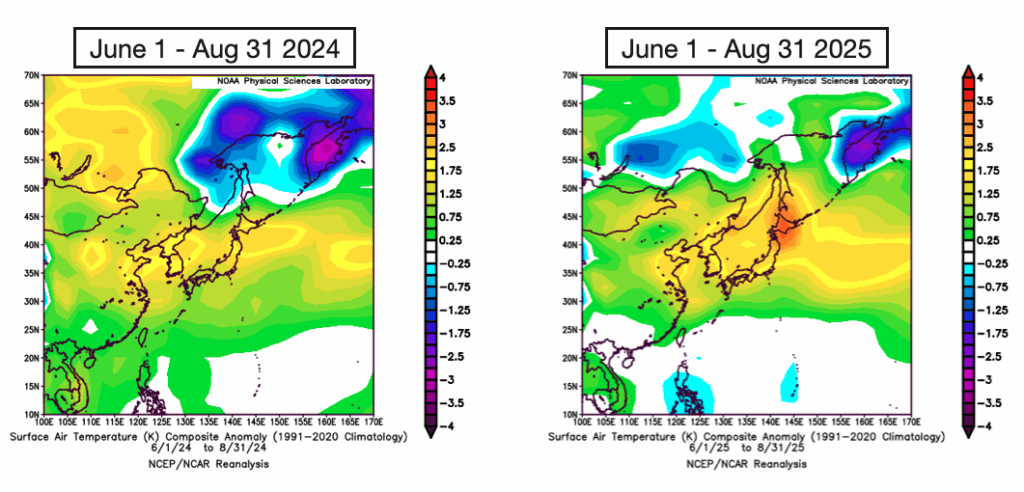

Looking at actually temperature anomaly, we can see northern Japan especially was warmer in 2025 versus 2024. The 2 seasons are side by side below.

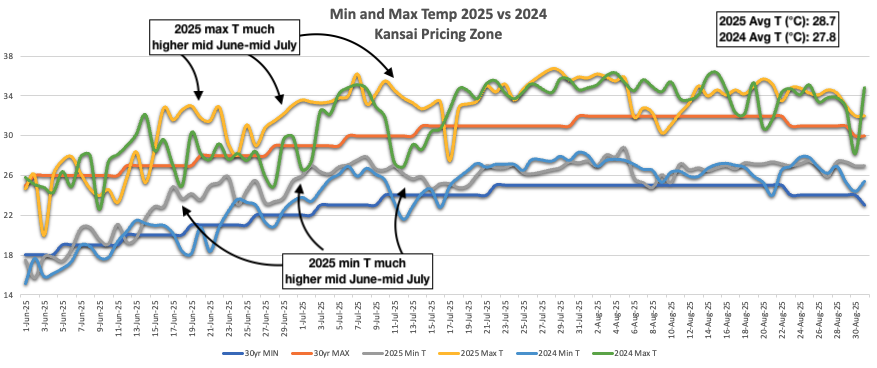

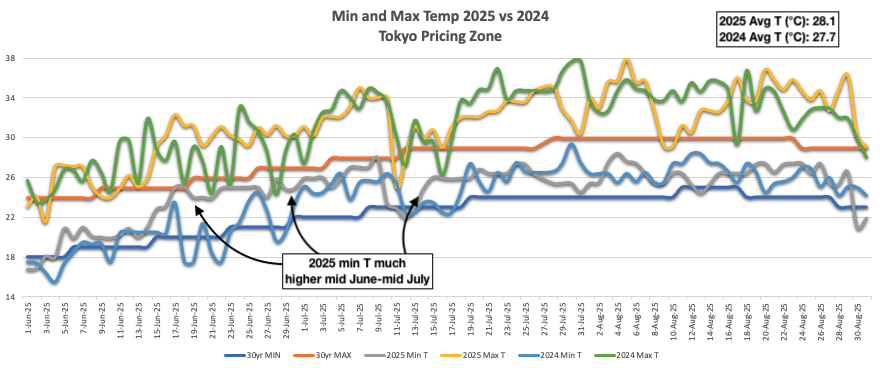

Digging deeper, we plotted population weighted minimum and maximum temperatures for Tokyo and Kansai regions for the past 2 June 1-August 31 periods (2024 and 2025). Notice the overnight lows especially (but even daytime highs) were hotter in 2025 especially from mid-June through mid-July. Daytime highs were a bit higher during that same period especially in Kansai. That was the difference in terms of what drove 2025 to be a bit hotter regionally, and we can mostly blame those very warm SSTs.

Bottom line: Tokyo was 0.4°C and Kansai was 0.9°C hotter in 2025 compared to what was observed in 2024 from June through August. This is because of ridging being a bit stronger, but more so due to SSTs being warmer, which allowed overnight low temperatures to be warmer than 2024.

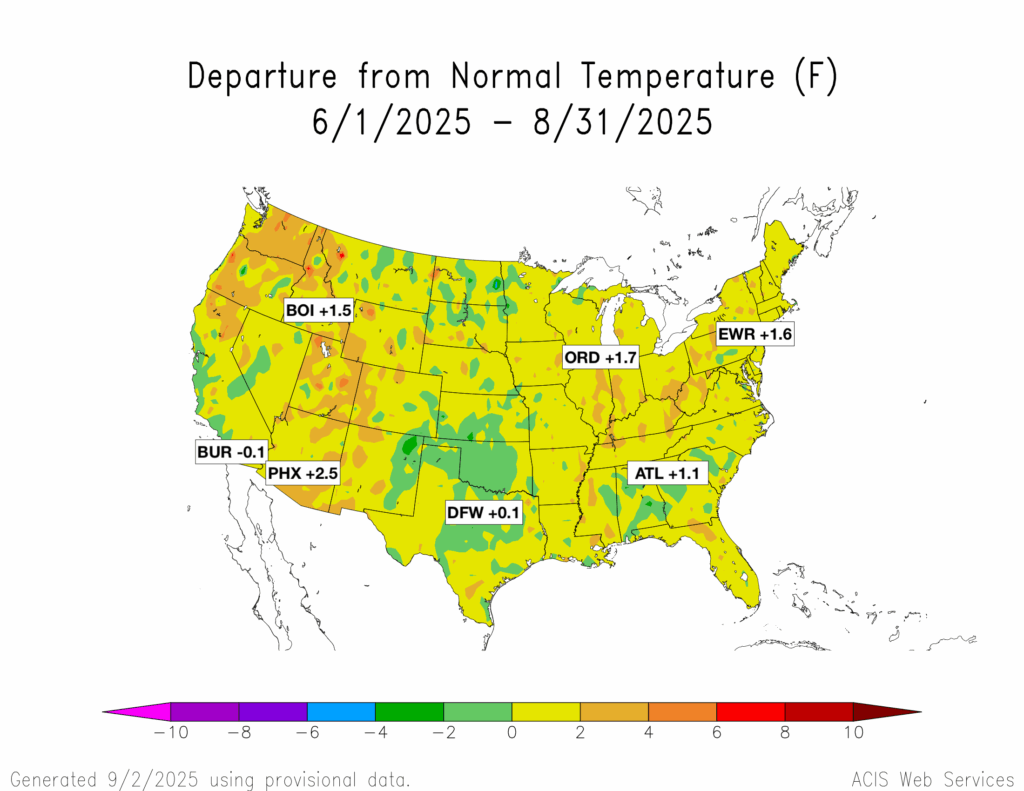

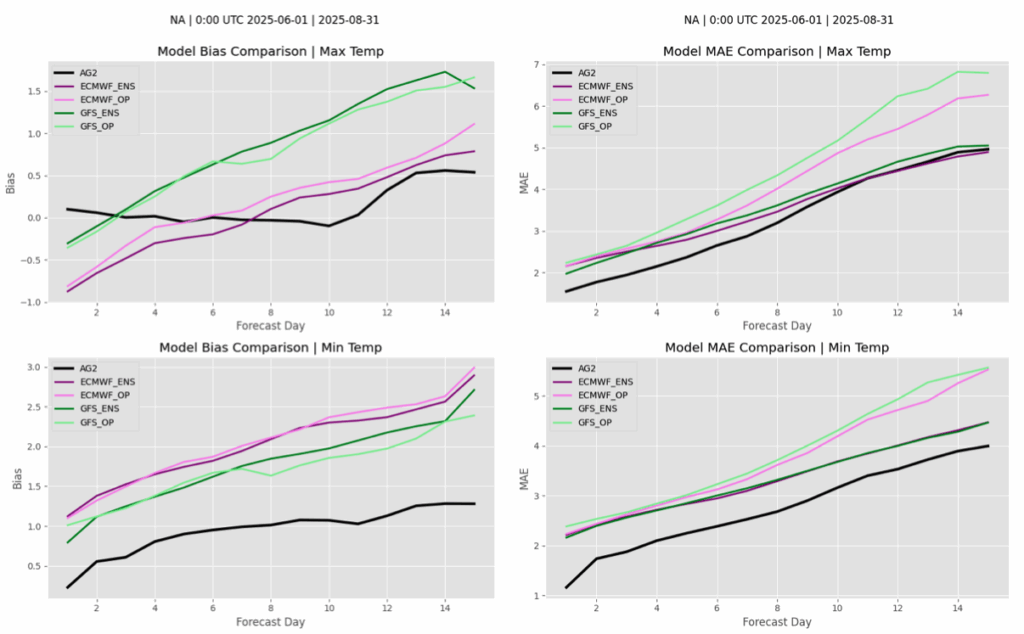

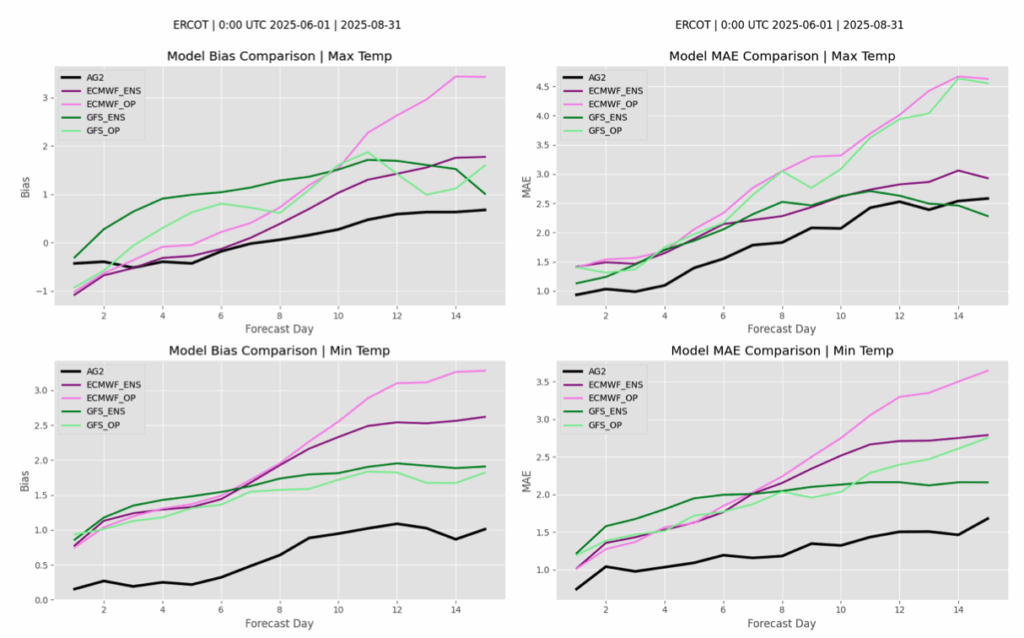

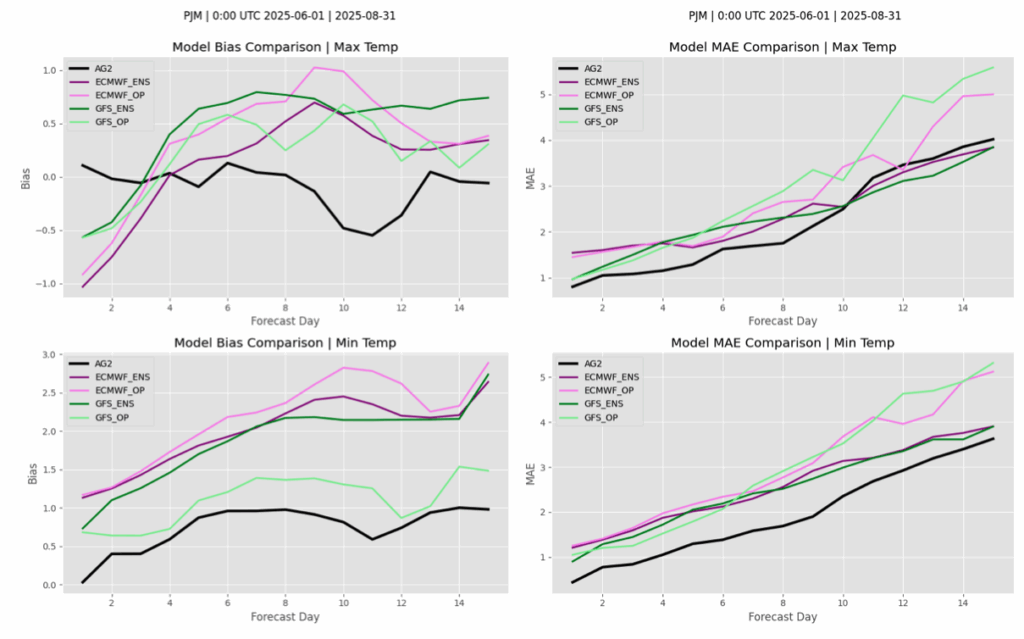

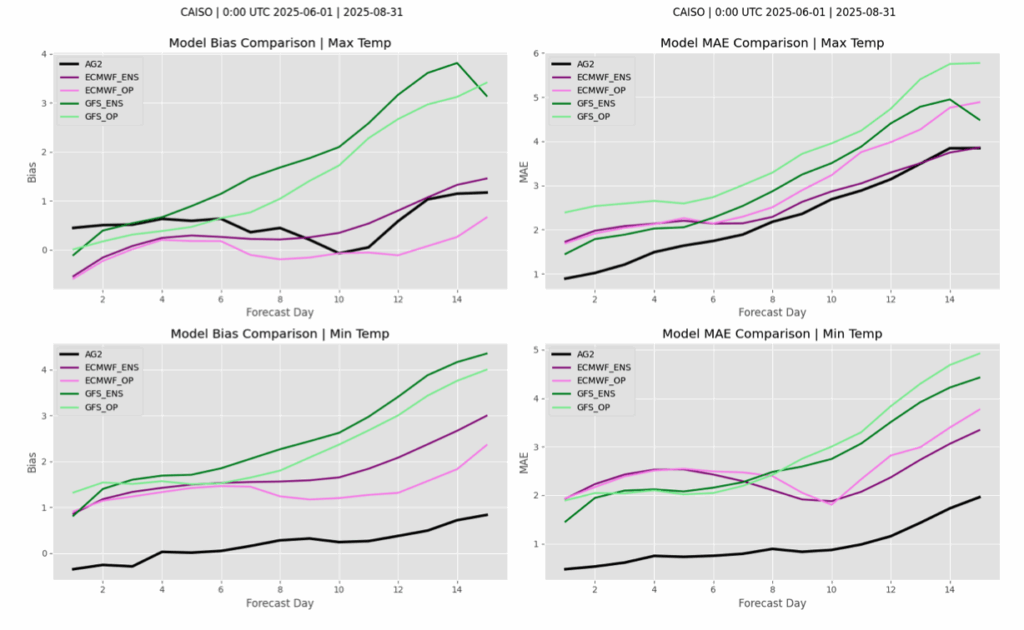

This quick hitter takes a look at AG2 temperature verification across North America and various ISOs this summer. Note the models on these charts are BIAS CORRECTED.

To start, let’s look at the temperature verification map for the CONUS from June 1 – August 31, 2025. Heat was spread out this year, with the Interior West and Northeast seeing extended periods, at times. All cities listed are cooler in 2025 compared to 2024’s June-August with the exception of Chicago (+1.7°F this year, +1.3°F last year).

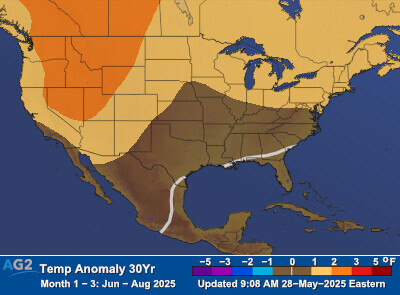

This was fairly close to AG2’s seasonal expectations – our map from the end of May for June-August is below.

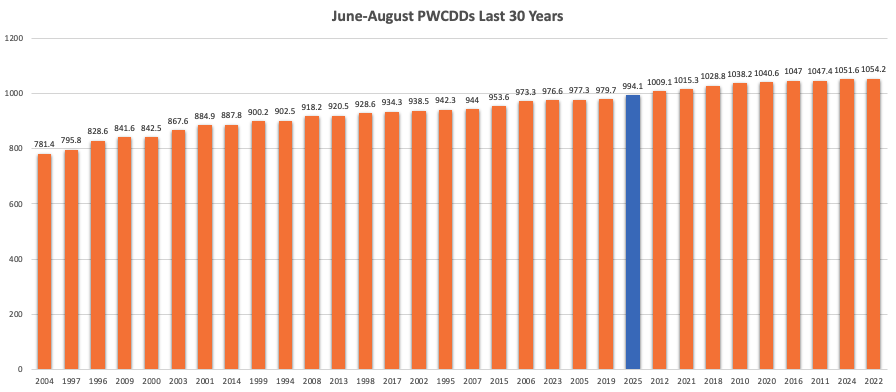

We ended the season with 994.1 CDDs, the coolest since 2023 (976.6) and second coolest since 2019 (979.7).

Starting nationally, AG2 MAE (black) was superior throughout in terms of max and min temperatures. The GFS ENS was generally the best performing inside 2 days versus other guidance. The ECMWF ENS was also quite good.

In ERCOT, AG2 was superior for much of the period for max temps, with the GFS ENS better day 15-16. The AG2 forecast was best for min temps throughout. Models were much too warm for min temps.

In PJM, AG2 MAE is generally the lowest/best throughout the 15 day period for both min and max temp, but did get challenged in the 11-15 day by the bias corrected GFS/ECMWF ENS for max temps.

Finally, in CAISO, AG2 was best throughout the 15 day period. The bias corrected ECM ENS was superior late in the period for max temps, day 14-15.

Bottom line: generally AG2 out performed all bias corrected modeling throughout the 15 day period. June-August ended with 994 CDDs. Models tended to struggle most with min temps, leaning too warm in many areas.